This week: “I’ve been working in HR and Operations in London for seven years. I moved here from Essex two years ago with my incredible partner P (who already lived in London) after finally getting a salary that would allow me to rent here (and eat). Last year I was in a team of five and now it’s just me running the Ops show. This year has been amazing for my career progression and personal/professional growth but awful for my anxiety. After a few meltdowns and many pep talks/therapy sessions from my incredibly supportive and lovely mates and partner, I have made it out the other side and there is hope on the horizon. And hopefully some cocktails too.

I’ve always been the ‘tight’ one of any group. Always saving on nights out and food, taking the bus rather than taxis, only buying bargains and only spending the dosh on my ultimate love, live music.

But this pandemic, my small pay rise at the start of the year and finishing paying off my CIPD (Chartered Institute of Personnel and Development) course (£230 monthly, last payment was in February…still elated) has made me realise that saving £4.57 on NOT evenly splitting the bill may not be worth it when I could be laughing instead.”

Industry: Tech

Age: 27

Location: London

Salary: £40,000

Paycheque amount: £2,307.87 after tax, pension and student loan.

Number of housemates: One, my partner P.

Monthly Expenses

Housing costs: £892.50 for my half of the rent, split with P.

Utilities: My half of the bills works out as council tax £75.5, energy £10.50, broadband and TV £22, contents insurance £6. We pay water quarterly and it’s normally £60 for my half.

Loan payments: £0. Only my student loan taken out of my payslip.

Savings? £2,000 Help to Buy ISA, £11,000 single access ISA. £2,000 emergency savings account. £6,000 split into two regular savers.

All other monthly expenses: Up until March 2021 I was paying £230 a month for a CIPD course. (I am very excited to see that money again!) £500 into regular savers every month – now that I have finished paying my CIPD, I plan on increasing this. Phone £41 (got a new one in a Black Friday deal). Tesco delivery subscription £7.99. Disney+ £5.99. P pays for Netflix and Prime. We paid for the TV licence in one go last year.

Refinery29UK is taking a leaf out of R29 US’s book and starting our very own Salary Stories. Did you negotiate a huge raise or take a pay cut for your dream job? We want to hear about about it. To take part in this (paid) opportunity please click here to fill out our submission form.

If you’d like to submit your own money diary, please drop us an email with some information about yourself: moneydiary@refinery29.uk

10.45am: Wake up, go to the bathroom, then straight back into bed. Check my eBay to see if it looks like I’m going to sell anything today. All my listings finish on a Sunday (so I don’t have to make multiple trips to the post office).

10.53am: Knock at the door scares me (too many true crime docs). We’re in a flat so we never get anyone knocking. Answer in my dressing gown. Package for P. Back to bed.

11.30am: Get up and dress in activewear (more chance I’ll actually be active). Grab some items to put on eBay. I made a pact last year to try and put five items on a week. I have a lot of clothes and doing this every week not only gives me a little trickle of income, it also makes me retry on loads of stuff, making me fall back in love with clothes I stopped wearing.

11.50am: Go into the living room as P is still asleep (he works nights). Look at what I need to eat in my fridge before my weekly shop arrives. Eat porridge with a cut-up pear, grab a Pepsi Max and watch The Mandalorian.

12.15pm: Get a hot chocolate, then brush my teeth. Start putting items on eBay.

2.15pm: Grab two Kallo chocolate-covered rice cakes and do my Tesco order for next week. Chill and read Depop drama Instagram posts and look at UK festivals online.

3pm: Watch Teen First Dates while walking on my treadmill. Amazed at the confidence of these teens, how well dressed they all are and how good their makeup is. All I had at 16 was glittery eyeshadow and cherry-flavoured gloss (which I still have and love).

4.10pm: A wild P appears. Eat some leftover veggie chilli with two mini wraps, salad, a Pepsi Max and watch Sunday Brunch (recorded). Rejoice over selling some items on eBay.

4.30pm: Cut up the last bits of salad in my fridge and add them to already leftover salad to make room for the Tesco delivery in an hour. Put away washing up, do more washing up and watch more Sunday Brunch, while making a list of festivals I want to go to.

6pm: Start collaborating with my mates about booking a trip to climb Snowdon in the summer.

6.16pm: Have four missed calls from an unknown number, probably the Tesco driver. Annoyed I can’t ring them back.

8pm: Take to Twitter and Tesco tell me they can’t get in touch to send the order back out so I book a delivery slot for tomorrow. Have yoghurt with a cut-up pear. Put Antiques Roadshow on (my fave Sunday night TV).

8.50pm: Tesco now tell me they might be able to deliver but they won’t know until 11.30pm. Wonderful. Eat potato waffles, salad and hoisin sauce (much better than it sounds).

9.50pm: Lie in bed and listen to a Stickmen live DJ set.

10.45pm: Brush my teeth and watch more of The Mandalorian with P. Fall asleep around 2am.

Total: £0

9am: Wake up, scroll through my phone, check how much money I have in my bank and ask Tesco on Twitter if they will refund me from yesterday (I was charged even though the food wasn’t delivered).

9.30am: Put on a big hoodie dress and PJ bottoms (the WFH uniform). Make porridge and cut-up pear (finally the last of the pears!). Grab a Pepsi Max. Start work.

11am: Clean the table before sorting out my eBay orders. I sold four items yesterday and made about £20 after postage and fees. Not bad.

11.20am: I forgot a colleague is going on garden leave today, so manically draft them a letter.

12.15pm: Find out someone at work has resigned. Feel disheartened but excited about their new opportunity. Have some Kallo chocolate rice cakes. Change into leggings from PJs to adjust to a more professional mindset (lol) and have a quick work call.

1pm: The employee placed on garden leave is ecstatic and wants to cycle to drop their laptop off to me right now. I calm them down and arrange the drop-off tomorrow over a coffee outside and exit interview in person.

1.30pm: Finish packaging my items for posting. £8.49 buying postage through eBay online. I have a 2pm call with my boss so I put a bra on (adds to my feeling of professionalism). Do my Invisalign scan. Put a brush through my hair and sort out an ASOS return for tomorrow.

2.30pm: Tesco comes halfway through my call (obviously). Put all my stuff in the hallway and jump back on the call. Manage to convince my boss to let me buy a 26-30 railcard through work as I need to make a work trip later this week. Win.

3pm: Put the food away properly (P and I eat separately most of the time and pay for most of our food items in the weekly shop separately). Call Tesco about a coupon for free bread not being accepted, get that refunded (every little helps). I bought: milk, grapes, apples, pears, tomatoes, rocket, lamb’s lettuce, spring onions, yoghurt, Pepsi Max, Go Ahead biscuits, Fibre One bars, smoked salmon, salsa and bread (free). £25.23

3.28pm: Break up a veggie burger and eat with salad in two mini wraps (and a Pepsi Max). I eat al desko.

6pm: Sort out my railcard and panic as it needs a photo. Scroll through my phone and realise I’ve not taken a selfie since October last year. Feel instantly less vain. £30 (expensed).

6.50pm: Me and my mates decide on a London day festival we want to try and get tickets to tomorrow. I realise I may be slightly tight on cash this month if I buy festival tickets for five tomorrow so transfer £130 from PayPal account into my current account. Thank you eBay buyers.

7.22pm: I have to go into work tomorrow so cut up a big salad to use for tonight and tomorrow.

7.45pm: Eat a vegan sausage roll and salad while watching Mastermind. Pack my bag with snacks and a drink for tomorrow. Back to work.

8.30pm: Mars DJ set in bed.

9pm: Watch the Harry and Meghan interview on my treadmill while eating an ice lolly and WhatsApping my mates about it. Regardless of what you think of the overall situation, the British press were definitely vultures with Meghan compared to Kate. I think she is very brave.

11.15pm: Write Mother’s Day cards, one from me and one from the dog (the favourite child). Put them both into a big envelope so I only have to use one stamp (smart/tight…you decide). Listen to the new Kings of Leon album in bed. Fall asleep at about 1am.

Total: £33.72

7am: Just no.

8.37am: Scroll. Get up. Make porridge with strawberries left over from a virtual cocktail night last week. Eat in bed while looking at emails. Talk to P about his night working and the price of crypto currently.

9.38am: When I leave the flat P is blaring Bowie on LOUD (I approve). Take the bins out. By some miracle my bus is waiting for me. Listen to the New Music Friday playlist on Spotify. £1.50

10.11am: Drop my packages and Mother’s Day cards off at the post office (I already had stamps).

10.20am: Work while waiting for my colleague to arrive. I closed down our old 45-person office for a tiny two-person office (essentially for storage) last month. Our lease on the old office was up and there was no point renewing an expensive office in the current climate, with our team half the size it was in February 2020. We are coming in to tidy the mess we left it in after the manic move.

12.05pm: End up missing out on tickets to the festival I wanted to go to. Oh well, there will be more!

1.30pm: Meet up with the gardening leave colleague and grab a hot chocolate and him a coffee, £5.40 on the company card. We walk outside and they tell me some pretty deep things which I start to process. £5.40 (expensed).

3.45pm: Finish the tidy up and I’m beaming with pride under my mask. After my team was cut from five to two last year in April (furlough then redundancy) and my boss left the business in January (the final original team member), my anxiety has been so high with taking everything on and learning new skills with no handover. So closing this task is extra satisfying.

4pm: It’s a beautiful day in central so I walk to a station to get my railcard attached to my Oyster. Walk past a pub me and P went to in February 2020 and feel a bit sad but hopeful at the same time. Take some scenic London shots for the ‘gram. £1.50 bus home.

4.30pm: Home. Realise I’ve not eaten since breakfast, put my uneaten tuna salad on a few slices of toast and eat in front of a nature programme.

5pm: Quickly hoover and put in my new aligner set. I started Invisalign last November and I can honestly say it’s one of the best things I’ve ever done. I paid in full as the bank savings rate is rubbish at the moment and I saved £60 paying all upfront. Well worth checking if you need to make a larger purchase and can pay in full, as the savings might be much better than the interest rate.

5.15pm: Rotate between working, listening to a David Guetta live show in bed and washing up.

9pm: Watch celebrity The Circle and GBBO back-to-back in bed. During this period I eat potato waffles with salsa and salad and a mountain of snacks. Delish.

11.15pm: See an email about a package in my letterbox from earlier today. Go down and grab it, it’s a dress I bought on eBay last week. Super cute. Happy. Read Money Diaries until I fall asleep around 1am.

Total: £3

5am: P wakes me up coming into bed. He WFH a lot during the night. Struggle to get back to sleep.

9.18am: Scroll, scroll, scroll, SCROLL. Scrolly-scroll scrolly-scroll.

9.54am: Annual leave today. Grab an iced coffee can, Pepsi Max and porridge with a sliced apple while waiting for tickets to come on sale for a festival, with a friend on loudspeaker (so we don’t accidentally buy more than we need).

10.05am: Success! Managed to get tickets to a day festival in August. £69.50 for mine.

11am: Find out another one of my mates wants to go to the festival too with their friend. She calls and I help her get tickets and we discuss other festival options.

1pm: Do my Tesco order, which I will be charged for when it’s (hopefully) delivered on Sunday. We started getting a weekly delivery during the pandemic last year. I’ve saved so much money as it’s forced me to plan and not impulse buy.

1.30pm: Plant my tree for the day. I downloaded Treeapp, which allows you to plant a tree in a different area in the world a day for free by watching an ad. It has an emissions calculator too which is pretty interesting.

2pm: Have smoked salmon, cream cheese and spring onion on toast, a Fibre One birthday cake square and look for a Mother’s Day gift. I send my mum two Melody Gardot CDs and add the new Celeste album as it’s free postage on orders over £20 and I think my mum would really like her. £20.97

3pm: Walk on the treadmill listening to London Grammar, then try and start working on a CIPD essay…the actual reason I booked a day off today. Get sidetracked into doing asset management work for a few hours.

5.15pm: Have some meat-free dippers with salad. Since January I’ve not bought any frozen meat products. Although I’m not vegetarian, at least it will make some kind of contribution. Book my train tickets to pick up some confidential documents tomorrow. £43.07 (with my new railcard). Paid on the company card.

5.30pm: Kallos, hot chocolate, washing up and then start setting up a new work laptop to use on the train tomorrow. My current laptop has a battery life of approximately 46 minutes (on a good day).

8pm: Chill with P for a bit and eat an ice lolly. Then watch The Circle while walking on the treadmill. I bought a treadmill and some small gym equipment in October 2019 as I was fed up with spending so much money on a gym membership. Little did I know how useful it would be.

9.40pm: Have some smoked salmon and cream cheese on toast, then finish off the strawberries with some yoghurt.

10.30pm: Watch The Mandalorian with P, then read a Money Diary. Sleep around 2am (which in hindsight was very silly).

Total: £90.47

7.47am: Ugh. My eyes hurt.

8.11am: Fall out of bed. Somehow manage to eat porridge with grapes.

8.22am: Leave and miss my overground train by 10 seconds. Terrific. £1.70 (railcard price, which I’m still thrilled about), will be expensed.

9.05am: Get to Stratford International to find that my train (which I’m 15 minutes early for anyway) is delayed by 35 minutes, which will make me miss my connection. I was trapped on an Overground train for three hours last week because of a fire at Whitechapel so this delay makes me quite nervous.

9.13am: Walk around a deserted Westfield trying to find an open coffee shop. It’s so strange seeing only two other people in the whole centre. I am incredibly aware of how deafening my squeaky trainers are on the shopping floor, as there are no other sounds to drown them out.

9.39am: Eventually go to the coffee shop near Stratford International station as I can’t find any others. Somehow I lose all of my social skills when the manager of the shop tries to have a chat with me. It’s the first time a stranger has spoken to me in months. £2.70

10.16am: Finally get on a train, sadly can’t have a call with a recruiter because of the bad connection. What a real shame.

11.51am: I am feeling quite emotional today. I have been following the news around the Sarah Everard case and it’s hit me quite hard. It really could have been anyone. By complete coincidence, I am travelling to Deal today, the place where the suspect lives, and I had to wait at Ashford for my connection, the area she was found. I spend a lot of time thinking about her on the train.

1pm: After meeting with a colleague and having a quick walk by the sea, I set off back to London. I grew up in a seaside town and always feel much better after being by it. I apply for a pay delay refund and instead of putting it back on the company card, I ask for it to go into my PayPal account. Very cheeky of me. Have some packed snacks and an iced coffee can on the train.

2.40pm: Grab a free sausage roll from Greggs on my way home from a work Perkbox code (my favourite work perk). £1 for the train, will be expensed.

3.20pm: Wonder why I still don’t have my email confirmation for the tickets I bought yesterday. Realise I missed the ‘L’ in ‘mail’ on my email address. *facepalm* Take to Twitter again to ask for help.

3.30pm: Eat some salmon and cream cheese on toast and make all the work calls I missed while travelling.

6.13pm: See ASOS is doing a 7pm-9pm 20% sale. I have been eyeing up a pair of boots and a coat in the sale that keep going in and out of stock in my size. I put them in my basket ready for 7pm.

6.48pm: Scroll through every pair of boots and every coat on ASOS to ensure I am going to buy my favourite ones. I find another coat I like so add that to my basket.

7pm: Sell an item on eBay for £5.50. Decide this is a sign to buy everything. The items are £295 pre-sale, £195 in the sale, £156 with the code, but I buy an ASOS voucher through Perkbox where I get 9% off, so it comes to £143.52. #maths

7.30pm: Reheat a frozen veggie chilli I made last week with a frozen veg bag and eat in front of Masterchef. Send my friend £62 for buying a day festival ticket today for me.

7.37pm: Remember new UK Drag Race is released on Thursday. Immediately put that on instead. Sorry, John and Gregg. Priorities.

9.50pm: See there is a vigil for Sarah Everard in Clapham on Saturday. Decide I’m going to go and pay my respects. Talk to a few friends about going as ironically I don’t want to go alone.

11pm: Decide candles are likely to blow out so find my xmas fairy lights for my tiny 2ft tree and put them in a jar ready to take to the vigil. Listen to Arctic Monkeys in bed and fall asleep around 2am.

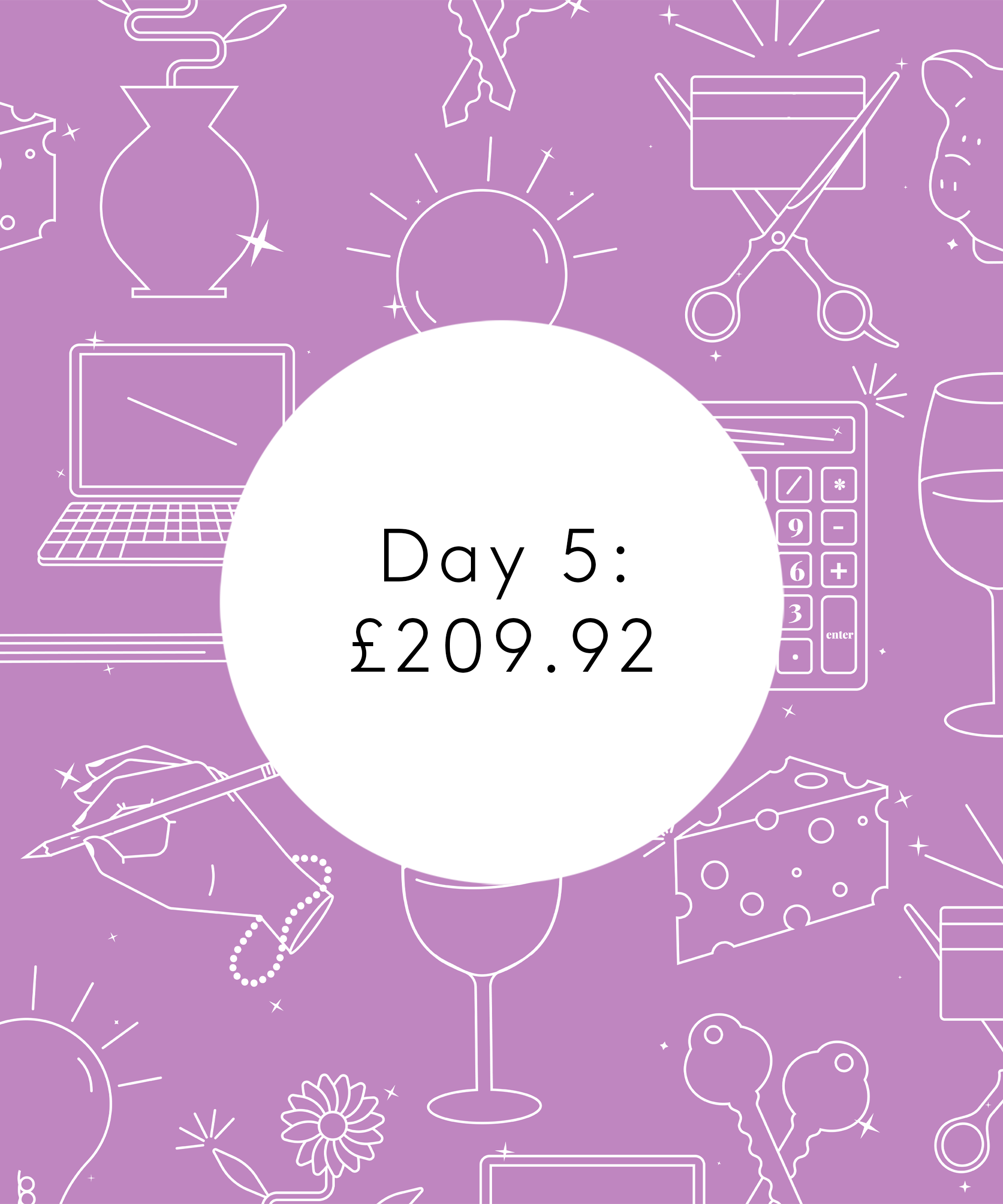

Total: £209.92

7.42am: I didn’t turn my alarm off from yesterday so I am rudely awakened by my own forgetfulness.

9am: Eat a chopped-up apple with porridge in bed. I love porridge so much. It’s like a cuddle in a bowl. Work.

12.30pm: The clothes I ordered yesterday arrive. A pair of blue snake-print boots and two faux-fur coats (to complete my Snoop Dogg/eccentric hipster look). The boots and one coat are no-goes sadly. I work out how much the other coat would cost individually with all the discounts. Decide I will try it with an outfit later and decide then.

1pm: Chop up more salad, add a tin of sweetcorn, put it all in a big Tupperware box with some salsa and shake. Eat the last of the veggie chilli with some of the salad I have just made.

1.10pm: Watch a work strategy video while eating. Get to one minute four seconds in and have already written down four things I need to research…the whole thing is 90 minutes long. The joys of working in tech. Have two Kallos for dessert

1.30pm: The Sarah Everard case has heightened my anxiety so I update my Tesco order for Sunday. For some reason updating my food shop really calms my anxiety. I think it’s because it makes me concentrate on something else and it helps me feel like something is organised.

3pm: Read that Sarah’s body has been found. Feel sick. Look at rape alarms online.

4.18pm: See that the service delay refund has come through to my PayPal. £32 woohoo.

5.32pm: Get distracted from work and start cleaning the flat. Run a quick mile on the treadmill and start working out while watching Amazing Hotels on BBC iPlayer.

7pm: Have two slices of smoked salmon and cream cheese on toast with lemon juice and rocket followed by a Fibre One square and a hot chocolate. I reserve a hotel for a day festival. It’s pay at property.

11.30pm: Longgggg shower. Watch The Circle and Masterchef while trying on all my clothes and picking some to put on eBay. I sell my old graduation dress on eBay. Reminisce. Read a Money Diary. Fall asleep around 3am.

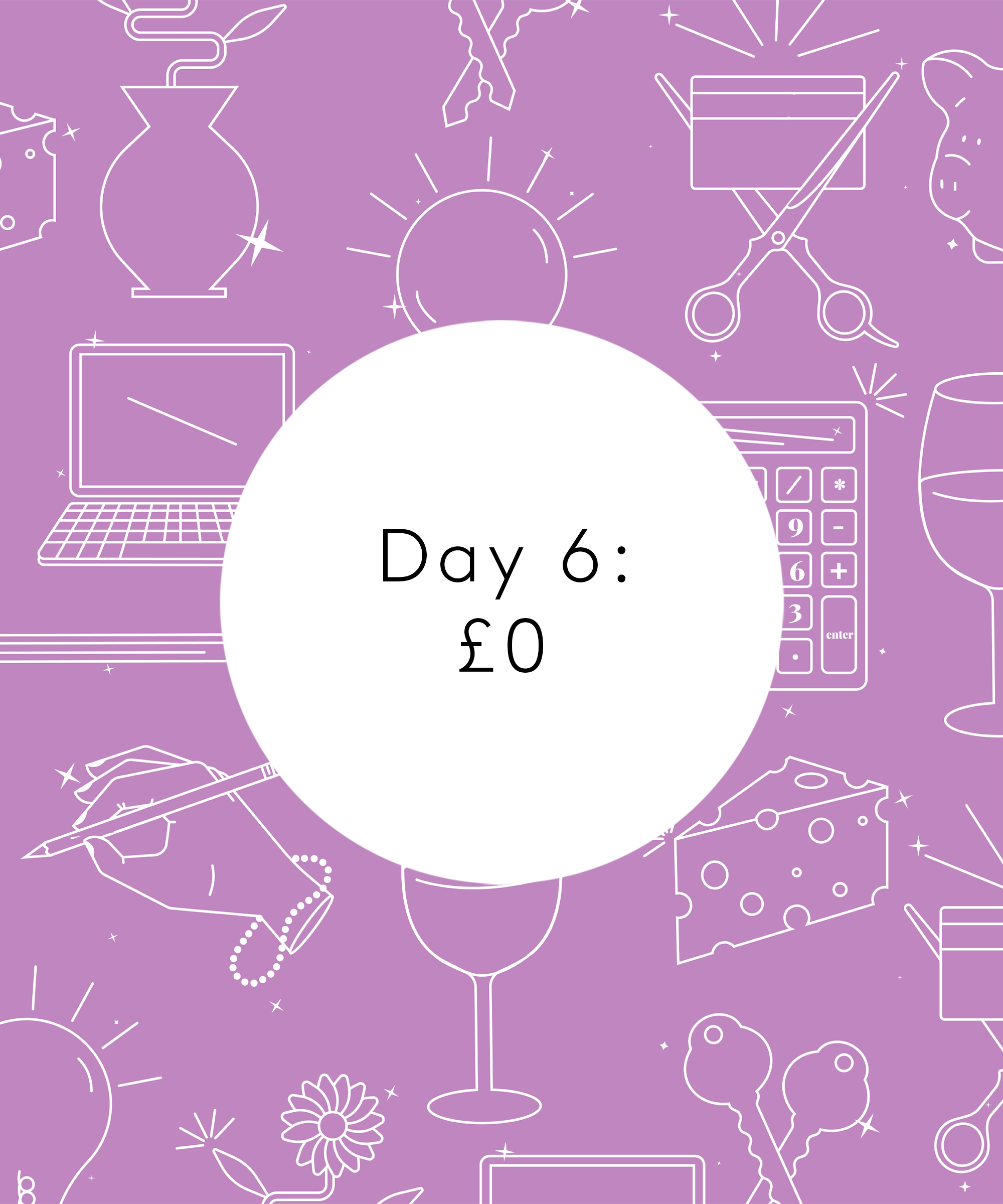

Total: £0

8.40am: Wake feeling very anxious and unsettled. Take some anxiety medication that I got prescribed at the start of the pandemic last year because of everything going on. Eat grapes and yoghurt in front of Drag Race US.

10.20am: Find out that the vigil for Sarah is cancelled tonight. I can understand why they’ve cancelled it but I’m disappointed. I found out yesterday that someone I know knew Sarah personally. I think a lot of people need a way to show their respect as a way of closure, even if they didn’t know her.

11am: Talk with P for a few hours about this and end up running through some self-defence moves.

1pm: Have salmon, cream cheese with lemon and rocket on toast. Then eat a few slices of fruit bread I found in the freezer and a hot chocolate. Decide fruit bread is my new fave thing, it tastes like a hot cross bun. Do nothing of consequence for the next few hours.

6pm: Decide I need to pay my respects to Sarah. Instead of going to Clapham, I compromise and walk to London Fields instead, much closer to where I live. I grab my makeshift lantern and head out on my own.

6.30pm: There are about 100 people there, socially distanced and everyone is in masks. The police are there but keeping to the side. I cry. The women in the crowd are chanting and I feel strong and empowered. And I feel safe.

7.15pm: I walk home alone. I get home safely.

7.30pm: Make a huge veggie fish finger salad wrap and eat in front of Ant and Dec’s Saturday Night Takeaway and The Voice.

9.30pm: Light a candle for Sarah and put my fairy light lantern in the window.

11pm: Eat loads of snacks in bed and cuddle with P. I feel more at peace. Fall asleep around 1am.

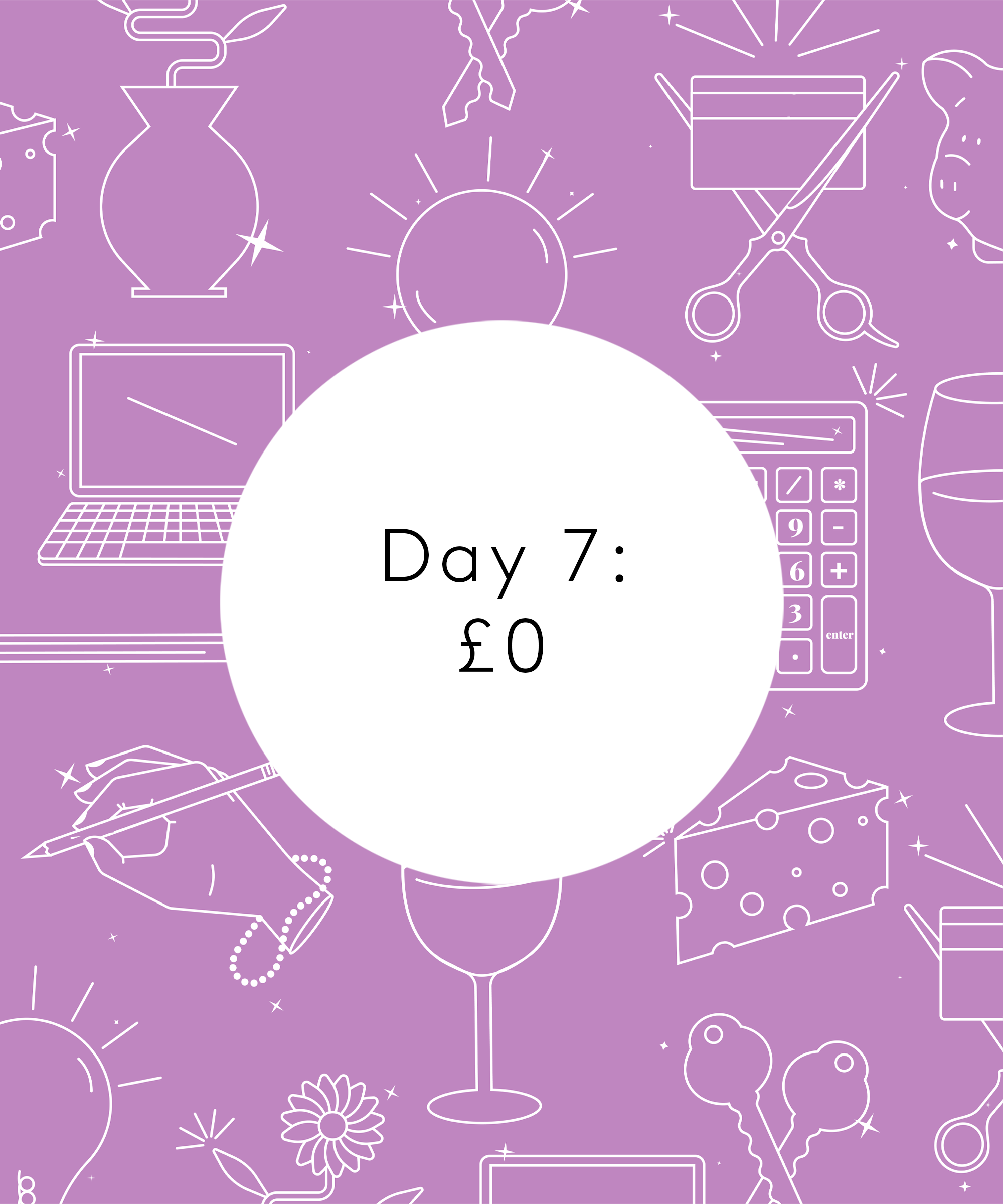

Total: £0

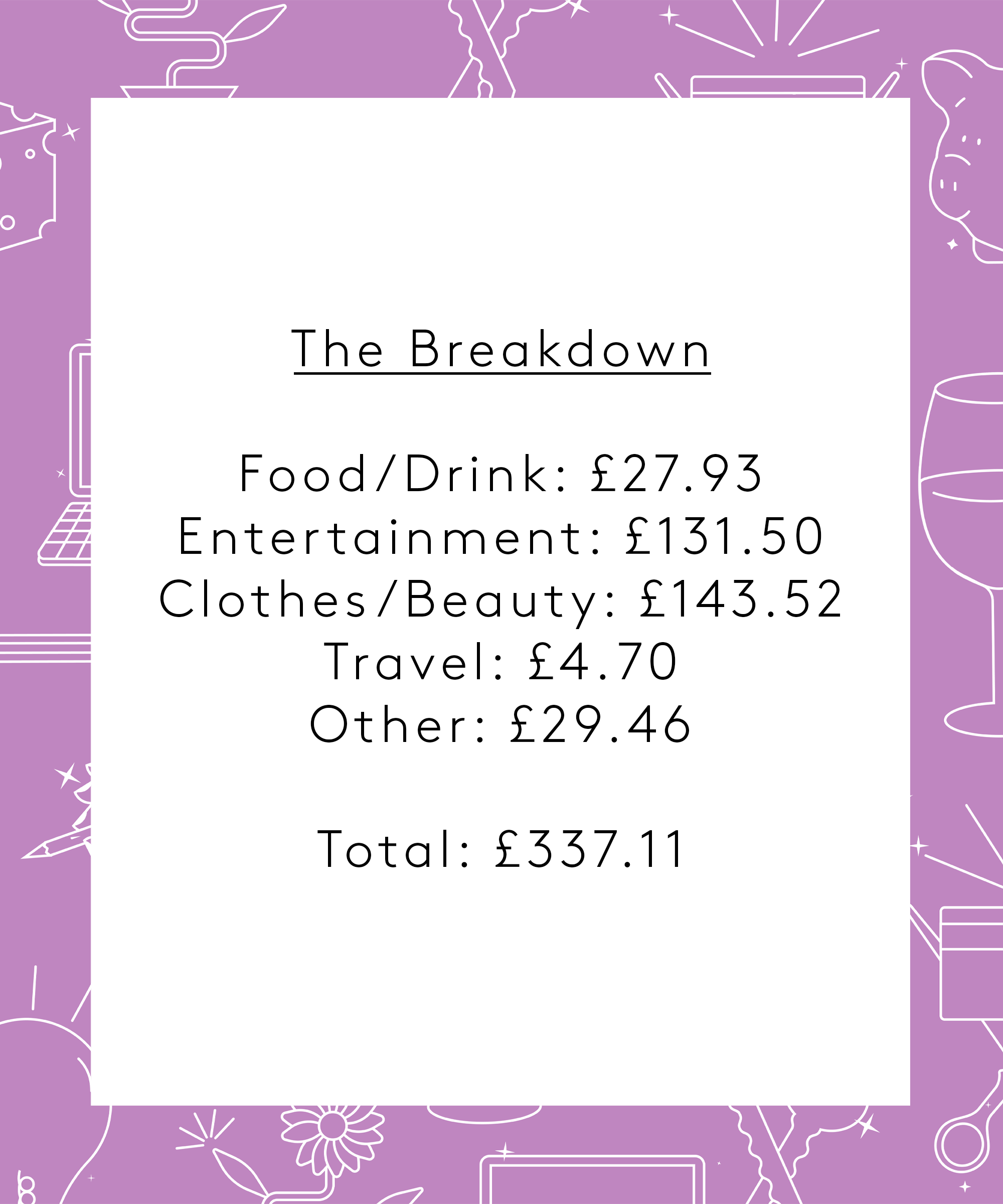

Food & Drink: £27.93

Entertainment: £131.50

Clothes & Beauty: £143.52

Transportation: £4.70

Other: £29.46

Total: £337.11

Conclusion

“This week was quite an abnormal week in terms of spending, as I don’t buy festival tickets that often. I do spend quite a bit at ASOS normally but I also return lots of items as well and get refunded.

What hit me hardest this week was how affected I was with what was going on in the news. Even in my eating patterns, I tend to eat the same easy things when I’m anxious, as mentally I’m not up to deciding to make anything else. I’m glad I want to the vigil. It’s given me some confidence back and given me some closure.”

Like what you see? How about some more R29 goodness, right here?

Money Diary: 23-Year-Old Legal Assistant & Student