This week: “I’m a 29-year-old marketing manager in the tech industry who recently moved to the UK from Hong Kong after several years of doing long distance with my partner.

I grew up in a family of teachers and was extremely lucky not to have any debt coming out of university. I received a full ride scholarship and worked multiple part-time jobs for my own spending money through the four years. I’ve been contemplating going back to school, maybe part-time, and will give this some more thinking over the next few years.

Looking back, my parents and I rarely discussed money and finances directly when I was growing up. But they have always lived frugally so I grew up with that behaviour ingrained in me. As my parents began to establish themselves more financially by the time I was in high school, I learned from observing them to spend money on not only necessity and planning well for the future but also on things you love. My parents both have things that they collect and will invest in without feeling guilty about it, and will splurge on special occasions. So I have tried to adopt that attitude as my income has increased over time.

Nowadays I’m quite comfortable and secure financially but it still sometimes shocks me how easily I can impulse buy things, knowing that my instinct is to pinch the pennies. I often question my purchases afterwards as well – like spending £100 on plants but thinking twice about getting the £2 over the £1.50 tea bags. If anyone has good insight into the psychology of this, please let me know!”

Industry: Tech

Age: 29

Location: London

Salary: £125,000

Paycheque amount: £6,100

Number of housemates: One, my partner B.

Monthly Expenses

Housing costs: £625. Live with partner B; we split rent half-half.

Loan payments: £0

All other monthly expenses: My partner and I recently moved in together and split rent, bills, groceries but keep separate accounts since it’s easier to manage for now. My share of monthly bills: internet £37.50, electric/gas around £60, council tax £145. Personal expenses: phone £5, Spotify £10, consulting website hosting £10, password manager £2.

Savings? Around £110,000 saved up in cash and investments. Around £2-3,000 each month automatically gets pulled into savings accounts and Nutmeg ISA pots.

9.10am: After lots of grumbling, I finally get out of bed. I work later hours on some days to better overlap with my team across the pond and today’s one such day. It was strange at first having all my free time in the mornings but now I appreciate having daylight when I’m ‘off’.

9.20am: Sip a hot lemon water while making some Nutella on toast, sneak in a few bites of leftover chocolate cake from the weekend. Ridiculously good. I say hi to my partner, B, and have a little chat. He’s already at ‘work’ (from home) but today’s a chill day for him. We’re lucky that we’re able to have separate work areas in our flat so we’re not in each other’s hair all the time, especially with our different hours. (He usually works a 12-hour day from 9am to 9pm so it’s nice to catch him during meals on weekdays.)

9.50am: Reschedule one of my meetings so I have a bit more time to myself this morning. I’m recovering from pretty constant back pain the last few weeks from sitting at my desk every day. This is the first week I have felt normal in a while so I’m trying to spend more time doing ‘slow’ things in the morning for myself and not rush into work first thing. Today, this means putting some flowers a friend sent over in water.

11.30am: Overdawdled! Rush to log on to work. Today’s going to be tough with several deadlines lined up.

1pm: Break for lunch with B. We don’t have time to make elaborate lunches during weekdays so we try ready made meals from M&S this week. The frozen spaghetti lunch is surprisingly not bad! We laugh at some of the funny texts we’re getting from a friend group text.

1.30pm: I’m back to work after a few more bites of cake. (Exercise routine must start tomorrow, I note. So sedentary lately.)

5pm: Order a book (via bookshop.org) for my book club. Excited! £12.46

8pm: Log off work. Feeling good to have resolved a few things with my team and making progress on a few stuck projects (and kept snacking at a minimum. Have been reaching for chocolate lately to fill the hole in my social life, not good!). Feeling physically tired but mentally wired so I do a quick meditation.

8.40pm: B and I have dinner (chicken with rice and green beans, one of our rotating weekday go-tos) and end up having an emotional talk about our future. I only moved to London a few months ago to end a few years of long distance for us and lockdown has not been kind to the idea that I could have a home here. Community connections are so important and I haven’t had the chance or time to really get to know this place in a way I need.

10pm: Finish our (now weepy on my side) talk and hug it out. I’m so grateful for B to always be there for me when I feel down through all the changes in this last year. I watch an episode (or two) of Grey’s Anatomy to calm myself. It’s been a refuge for me in lockdown. Shondaland manages to be soothing even while blood is everywhere and there’s lots of drama. I’m only on season six and the thought of having 10 more seasons to go through every time I have a bad day is oddly comforting. Conk out at 11.30pm, completely exhausted.

Total: £12.46

9.15am: Haul myself out of bed. I do some consulting on the side to supplement my income and keep my skills sharp outside of my job. I have a client call this morning. Nutella on toast, lemon water and no more chocolate cake. I’m not big on routines but this breakfast one is a no-brainer.

12pm: Finish my call – client is happy and we’re making progress – and join a work call. I’m changing roles in my team so they need to renegotiate my contract. It’s been a stressful time to be constantly advocating for my value in the company but I’m glad the team has been very supportive as we get close to finalising things after weeks of these talks. I’ll be taking a slightly lower salary, which is tough. But the reasons all make sense (biggest thing is a change in cost centre) and I’ve pushed hard beyond their original offer. Hopefully one more round to go before we settle.

12.20pm: Start work, stomach grumbling. I try Headspace’s meditation work music to spice things up a bit but it just makes me oddly hungrier…

1.30pm: Break for lunch! M&S pizza and some salad leaves. B and I chat about the calls we’ve had this morning and how we’re trying to get into ‘Friday mood’ in lockdown but it’s hard to differentiate…

2pm: Back to work, ironing out some tricky documents, but find my attention drifting from nice weather. A client call gets cancelled so I take a cheeky jaunt to the high street to pick up some CeraVe moisturiser. I tried a new moisturiser a week ago and my face is still recovering from the sudden inflammation and breakouts. It’s suddenly leathery and dry as well so I thought going back to basics with CeraVe might help. £9.74

4pm: Back home, prep for some final meetings and look forward to moisturising my skin later. The state of this week, ha! That I’m so excited about lotioning is a new low.

7.45pm: Finish up work, do a quick workout to start my exercise routine. Saved by the bell when Deliveroo order for Friday burgers arrives! £28.68

8.30pm: Call home and catch my family up on the week before watching Superstore with B to round out a happy Friday.

Total: £38.42

10.30am: The weekend really came out of nowhere this week! It’s a chilly morning so we have a lie-in and have a chill breakfast, reading and chatting. We decide to head to explore a neighbourhood close to us in the morning to check out if any of the flats on sale are worth looking into. We’ve just started talking about potentially buying a place in the next few years and are taking the long route by doing tentative explorations first, since we both know so little about this market and London neighbourhoods in general.

1pm: Long walk complete. The neighbourhood was really nice and we’re thinking of doing some more internet searches later to see what kinds of properties are available.

2.30pm: Late lunch and some catch-up calls with friends. I had a few regular catch-ups scheduled even before lockdown began since most of my closest friends are overseas. It always feels good to spend some time with them, even if it’s virtual.

5pm: Look into buying some tech equipment to help set up my brother for extended work from home. He’s been very stubborn about working on his laptop this entire year but when chatting about both of our back problems, he’s finally open to making a real setup. I told him I’d get him something nice as a gift. Find a decent size monitor and a webcam and some wires online. Comes to £128.79.

8.45pm: Dawdle rest of the afternoon away by reading detective novels. I’ve recently got pulled into the Cormoran Strike series since they’re fun and quick. B and I have dinner: roast lamb shoulder he got from the butcher’s earlier and veg. We have a bit of apple cider to go with it and turn in for the night to watch the Formula 1 docuseries on Netflix a few friends have recommended. It’s actually really engrossing!

10pm: We conk out after one episode since it’s been a long, tiring day of not doing much, ha.

Total: £128.79

7am: Get up very early and can’t go back to sleep. Decide to read the detective novel on my phone (I’ve been using my library’s ebook collection and it’s so convenient to squeeze in reading when I’m too lazy to get a physical book from the other room). Doze off at some point.

8.45am: B and I are both up and thinking of going for a long walk to a nearby lake. We’ve heard there are new ducklings and want to see if they’re out.

9.30am: Another chilly day so not many people around, which makes social distancing easier. I always wear a mask when out, no matter where I am, and B is a bit more relaxed. Sometimes I’m afraid of how difficult it will be to reintegrate into normality again once lockdown eases since I definitely feel more on edge than most other people I pass on the street, it seems. I guess time will tell how we’ll figure out this next phase.

9.50am: Spot the ducklings, they’re so adorable! Very fluffy and small, following their parents around. Also spot at least five rats in the woods, stealing the bread some people are throwing to the ducks – it’s disturbing how large and unafraid they seem. Much less adorable!

1pm: Home for a late lunch, some more catch-up calls with friends. One of my best friends from school got a new puppy! It’s so adorable.

3.30pm: Head out again to do our week’s shopping at Tesco. (So adventurous, leaving the flat twice in one day…) It comes to about £34, B pays. We’ll split the cost later.

6.15pm: Take an accidental nap after reading, odd. I’ve been sleeping so much more since I’ve moved to the UK, not sure if it’s the weather or my lack of exercise. B and I do a workout together. I’m so out of shape that I have to take plenty of breaks but glad at the end I did it. We hype each other on throughout, which always helps my morale.

7pm: It’s chores day! I do my end of the chores while watching the first episode of the Strike series on BBC: overdue dishes from lunch, deep clean the bathroom, clean up our desks, plants and flowers, and help out with the laundry.

8.40pm: It’s leftovers night, per our usual Sunday fare, so we tuck in and debrief our weekend a bit. I call home and chat about how I’m feeling meh about ‘returning’ to work tomorrow and catch up on how my family is doing. It’s nice and sunny where they are which makes me glad they’re spending lockdown in nicer weather.

Total: £0

8.40am: Wake up groggy to find it snowing! But it’s spring? Both alarmed and impressed by unpredictable British weather. Read in bed until absolutely feel the urge to go to the bathroom.

9.15am: Get settled in for a slow morning of easing myself into what I know already will be a tough week, based on the pings I got over the weekend. I’ve been having a really hard time finding willpower and discipline when it comes to work – even when it’s work I end up loving – partly because I’m so uninspired by being in my flat all day in lockdown and disconnected from this new team I’ve joined. I try to just let myself be on days like this, and end up journalling about it for an hour or so before planning my week out.

12.30pm: Finally pull myself out of lazy Monday stupor – ended up eating Colin the Caterpillar candies and watching some more TV, ugh. We have a quick lunch – sandwich, soup, salad from our shop yesterday, the usual – and I get ‘stuck into’ work. (Picking up more British slang as I read more British books, absolutely ‘chuffed’!)

2pm: Take a break to do some household chores. Wanted to go for a walk but the now sunny weather is still freezing so satisfy my urge by watching people bundled up on the crosswalk outside instead. Air out my office with windows fully open while in shorts until B comes in saying it’s really cold.

4pm: My mind refuses to focus so shift some of the thinking-heavy work to tomorrow morning (a presentation to my team tomorrow evening) and take an online training I’d been putting off for a while that will help me prepare for a new project starting this week. I’m hoping starting the presentation on the same day I’m presenting will be a helpful way to manage my time and not too anxiety-inducing. Hop into a handful of meetings to close the day while snacking (way too much) on three kinds of chocolate nearby.

5.10pm: Lull before my final meeting of the day, feeling uninspired with the day so far.

6.30pm: Last meeting of the day really kicked my energy and mood up a notch – combined with a gorgeous setting sun that warms up my face. Very efficient and excited to work some more tomorrow on what my teammate and I talked through.

6.45pm: I entered the wrong credit card info for the monitor I bought my brother so call the helpline to amend. The woman I speak with is so nice and patient, keeps calling me ‘my dear’ as we work through the error – I’m grateful for folks that keep businesses running in strange times in such caring ways.

7pm: Beautiful sunset was so inspiring, I decide to spend an hour stretching and working out. I think more than body shape or size, the biggest motivator for me this week to get back into exercising is that I can’t breathe or feel my face after only five minutes of a cardio warm-up. This is so scary to me. I’ve been lucky that I don’t gain weight easily but even so, cardiovascular health is really important. If I want to be a healthier person, it starts with me.

8pm: Workout complete! Check in with my family and tuck into dinner.

8.40pm: Browse frames online to see if we can frame up a print that was gifted to us when we first moved in. Have been procrastinating on this for months. Neither B nor I has a single design bone in our bodies… Make some Genmaicha tea (mmm my favourite) and deliberate.

9pm: Oof that was painful. Ended up getting a cheap basic frame while we discuss different options for other prints we’re keen on to hang on the walls. Turns out both of us don’t care that much until our vague interests are not aligned! Decide to keep thinking about it…maybe for a few months longer? £20 for the frame from Amazon.

Total: £20

9am: Woke up sore from the workout but also refreshed. Now that the days are getting brighter earlier, it’s much easier for me to get out of bed. I eat breakfast (switching it up with some granola today instead of Nutella-bread) and do a morning yoga routine on Headspace. Work up a small sweat. Wow, liking this new can-do version of me in the mornings.

9.45am: Read for a bit – it’s my last day with the detective book before I have to return the ebook hold to the library but I’m still 45% away from the end. I will just have to wait two weeks and hope the next reader is fast! Shower reluctantly since I’m on a cliffhanger of a chapter (aren’t they all…).

10.30am: Have a quick catch-up with a friend who’s thinking about switching jobs. Since I’ve done that a few times, I offer some advice but mostly give space for her. It sounds like she still has a few things she needs to figure out for herself and my perspective won’t help much at this point.

11am: Log into work and finally tackle that presentation I have to give today. Due today, do today? Do deep work time over the next couple hours and get a significant chunk of it done.

1.30pm: Break for lunch. Bread with cheese, soup, salad. So grateful for B for fixing up our meals and making sure I get fed. Before we lived together, I subsisted mostly on cereal and fruit and candy, like some weird woodland creature in a big city. One of my personal goals this year is learning to cook more and take over half the meals.

2pm: Get back into it and finish up the presentation before knocking a few other to-dos off my list. I have a quick meeting with a teammate where it looks like I’ll be joining a client pitch tomorrow, so that’ll be an interesting first with this team.

7pm: Finish the presentation and feel happy about the positive feedback from the group. Can’t believe my luck that the sun’s still out! Go for a quick run to M&S to pick up some – feel bad I haven’t cooked all week so making up for it with other errands – and enjoy browsing around. I’ve always loved grocery stores – for some reason, seeing all the food stacked up is so comforting and there’s always something new to discover with British stores. What in the world are rice cakes?! End up spending £12.70.

9pm: We have a very fishy cod and are disappointed but meal redeemed with some cheesecake I picked up from M&S earlier. I spend the next hour or so responding to some informational interview questions I’d received via email from a friend that needs it for one of his business school classes. We decided that to save time, I could just type responses instead of us trying to find a time between timezones. I end up typing six pages or so! This may be handy down the road to share with others interested in my job and what I do.

10pm: B and I get ready for bed and decide not to watch any TV. We snuggle up and end up chatting for 30 minutes in bed about our day and other things going on in our lives, and our life together. It’s super cosy and once he puts on Classic FM – our favourite station – I’m conked out after five minutes.

Total: £12.70

9am: Some crazy dreams last night, lots of scary detective novel-like scenes. Maybe it’s good I’m on a break with Cormoran Strike! Get up and do a few stretches on the yoga mat to shake it off. It’s sunny and cool, such great weather to be in. B and I chat over breakfast and he laughs at how quickly I fell asleep last night.

9.20am: Breakfast is a chai tea to switch things up, with Nutella on toast and one happy Babybel cheese.

9.45am: Shower, do some light cleaning around the flat. Feeling nervous about work later but trying to protect this time without ‘morning scaries’.

10.30am: Finally settle in to work. Because the client call today will be focused on more technical elements, I need to brush up on my own knowledge as well.

1pm: Break for lunch: pizza, salad and some nice scrambled eggs.

2pm: Dial into a team meeting where I don’t have to speak and do some more prep on the side for the call later this afternoon. Check out a few ergonomic pillows online to see if I should order one. While my back issues are at bay temporarily, I do still get really tense neck when I wake up so wondering if any of these will bring relief.

3pm: Have my final chat with HR about my renegotiated contract and it feels like it’s in a good place. I’m grateful that they offered a sign-on bonus to try to bridge the gap. It’s higher than I expected but probably has some room at the top – but I sense that my team is weary of another round of negotiations and as B suggested, it’s good to leave some goodwill.

5.45pm: Phew, finished the client call, which went relatively well. I was happy to receive some positive feedback from the team, considering it’s the first time I’ve pitched in this environment and on the particular topic. Have a light snack to ready myself for a last meeting of the day. The sun is back and there are gorgeous fluffy clouds in the sky – brings me to such a good mood after a long day.

7pm: Log off work, energised by the last call. I love it when there’s clear directions for improving on something and the team feels motivated to cross the finish line. Go for a quick walk around the block to admire golden hour at such a late time! There is hope yet if there continues to be nice long days like this instead of the short days in wintertime.

8pm: B returns from a quick shop where he spent £16 or so. We book in a Tesco delivery for larger food and household items that comes to about £65, which I put my card down for. Dinner and putting our art print into the frame as our evening activity. Pillows purchase on hold for now, might ‘sleep on it’ some more… £65

Total: £65

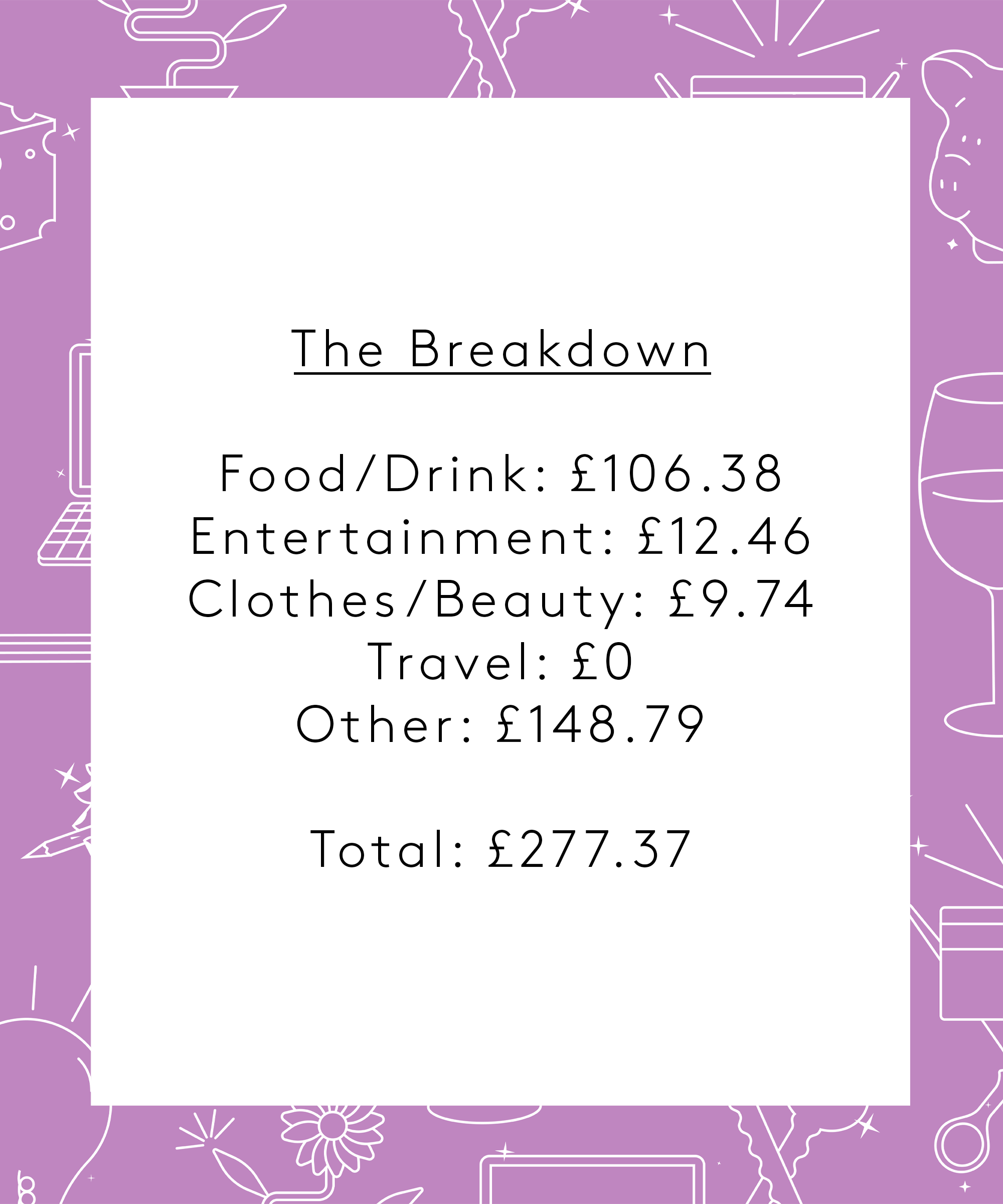

Food & Drink: £106.38

Entertainment: £12.46

Clothes & Beauty: £9.74

Transportation: £0

Other: £148.79

Total: £277.37

Conclusion

“Looking back, I’m fairly glad that there were no impulsive purchases and I was mostly sensible with my spending this week. (Not every week is as level-headed, with lots of random gizmos around the flat to show for it!) I did notice that we spend a significant amount on groceries per week just for the two of us so that’s something for us to look into going forward. I’m glad I did this exercise. It’s made me more mindful of where I try to save when it doesn’t make sense to, and where I should be more cost-conscious but am not currently.”

Like what you see? How about some more R29 goodness, right here?

Money Diary: An Investment Analyst On 50k