Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last penny.

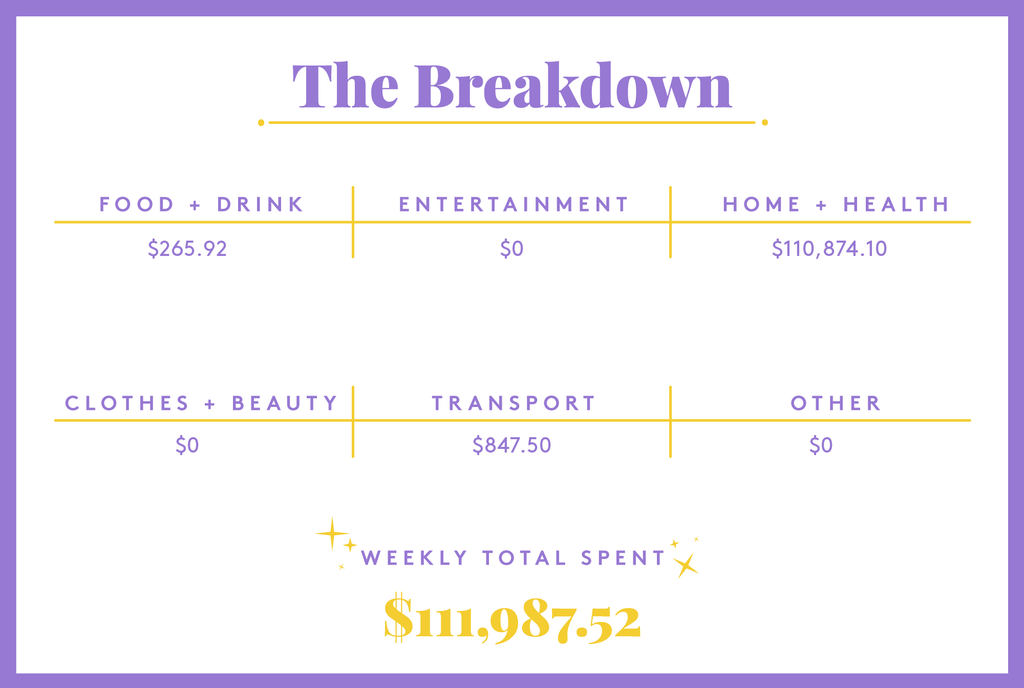

Today: an engineering manager who has a joint income of $665,000 per year and spends some of her money this week on a house.

Currency written in USD.

Occupation: Engineering Manager

Industry: Technology

Age: 28

Location: Dallas, TX

My Salary: $190,000 base + $40,000 bonus + $250,000 in stocks

My Husband’s Salary: $185,000 (he is a software engineer)

Net Worth: $1.4M ($1,000,000 house we purchased this week + $500,000 in retirement accounts + $400,000 in investment accounts – $500,000 mortgage)

Debt: $500,000 (mortgage)

My Paycheck Amount (2x/month): $3,500

My Husband’s Paycheck Amount (biweekly): $5,915

Pronouns: She/Her

Monthly Expenses

Mortgage: $3,500 (split with my husband)

Charitable Donations: $1,000

Utilities: $200

Internet: $70

Cell Phone: $50

Spotify: $17

HBO Max: $15

Health Insurance: $50

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

Absolutely. There wasn’t any question about whether or not I would go to college. I was fortunate enough that my parents worked super hard and were able to pay for the majority of my college tuition and expenses. I graduated college with a $21,000 loan that I was able to pay off during my first year working.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

My parents came from poor families and raised me to be pretty frugal. They emphasised the importance of saving money and only buying things we absolutely needed. This mindset towards saving helped me to build an investment portfolio early on in my career which has contributed greatly to my net worth.

What was your first job and why did you get it?

My first job was in retail when I was 17. I got the job because I didn’t want to ask my parents for money whenever I wanted to buy clothes or go out to eat.

Did you worry about money growing up?

I did not because my parents never revealed their financial situation to me growing up. Looking back, I realise my parents definitely faced financial struggles, especially from when I was born until I turned five. My grandparents raised me during these years because my parents worked 12-hour days managing a family-owned restaurant.

Do you worry about money now?

Yes and no. My income is super comfortable for the area that I live in, but there are certain things I still don’t feel comfortable spending money on (business class flights, nice hotels, coffee at a cafe) because I would rather invest it in the stock market instead.

At what age did you become financially responsible for yourself and do you have a financial safety net?

I became financially responsible for myself when I graduated college and got my first job. I know that my parents would support me if I lost my job, so I consider them my financial safety net. I realise that I am super fortunate and privileged.

Do you or have you ever received passive or inherited income? If yes, please explain.

While not technically inheritance, I consider my college education the foundation that allowed me to build my career and earn the income that I do now.

Day One

7 a.m. — I wake up. Today’s a big day! I’m closing on my first house, which is a five-bedroom house in Dallas, TX. My husband and I started this journey of building our custom house two years ago and it’s finally finished. COVID supply shortages and the Texas freeze delayed progress on the house for a few months, so we’re super excited that this day is finally here.

9 a.m. — We eat some cereal with fruit and almond milk for breakfast and pack some sandwiches for lunch to take with us. We won’t have much time between our final walk through and heading to the closing table so I’m making sure that we have some food to go. We hop in the car and start driving to the house!

10 a.m. — We do our final walk-through with our builder. There are a couple of minor things that still need to get done (paint touch-ups, fix a broken light fixture) but they promise to get those done in the next few days. The house is looking AMAZING and everyone is super excited and happy!

12 p.m. — We head to a local library for internet since we need to check up on work. My team has some big features we’re releasing so I need to make sure no one is blocked on anything and QA testing is going well. We eat our sandwiches while we work.

2 p.m. — We arrive at the closing office and sign probably about 100 pages. Some of the pages have incorrect information so they have to reprint them. We sign them again. Our hands hurt. We hand over a check which includes our down payment and closing costs ($98,414) which is our largest purchase to date. It’s important to note that we signed a contract on this house for $650,000 two years ago, and since then the value of our home has gone up to $1,000,000. $98,414

5 p.m. — Three hours later, we are finally done! We get our keys and head to the house! We have been living in a hotel for the past week and brought three suitcases with us (and other miscellaneous items) so we want to drop them off instead of lugging them around in the car. We’re in a hotel again for the night because our mattress arrives tomorrow and we don’t have any furniture in the house to sleep on.

8 p.m. — We get burgers and fries at Sonic for dinner since it’s close to the hotel. $12.45

10 p.m. — I take a shower and its lights out! Today was exciting and also super tiring. We’re ready for a good night’s sleep.

Daily Total: $98,426.45

Day Two

7 a.m. — Wake up and head to the hotel gym. I do a 45-minute full-body strength Peloton workout. I’ve been doing Peloton app workouts for the past year and a half, but I’m excited to build a home gym so I can start power-lifting again.

8 a.m. — We eat breakfast at the hotel. We take some yogurt and oatmeal to go. Not bad for a budget hotel. We check out and don’t owe anything because our hotel was booked with loyalty points.

9 a.m. — Back at the house. Today is appliance and furniture delivery day. Our fridge, washer and dryer, mattress, coffee table, bedding, dining chairs, and kitchen island chairs are all arriving today so we’re on standby to receive those deliveries.

10 a.m. — I check into work for around two hours of meetings. Thank god we were able to get our internet set up before this. I conduct a technical interview with a software engineering candidate and he nails it! Hope he joins.

1 p.m. — Eat leftover yogurt and oatmeal from breakfast for lunch. So happy we took food to go since we have no food at the house. I also online shop for some home items and buy All-Clad pans ($479.80) and a Brooklinen towel set ($120.40). Since this is our forever home for the foreseeable future, I want to buy quality items that will last. $600.20

2 p.m. — More meetings. I panic and realise that my moving truck won’t be arriving for a few more weeks so I buy some essentials — plates and utensils from Target ($60.19), a rice cooker ($21.10) from Amazon, a Sony Bravia 75-inch TV ($1,899.28, yes, I consider a TV essential), a drill used to mount the TV from Home Depot ($81.12), and a TV mount ($59.24). I work for a few more hours doing code reviews and have a few meetings with my direct reports. $2,120.93

6 p.m. — Head to our local grocery store and pick up groceries for the week. We get $75 worth of groceries expensed by my husband’s company so I try to stay under that number for this trip. We get eggs, chicken thighs, green peppers, avocados, cherry tomatoes, baby spinach, onions, garlic, zucchini, strawberries, blueberries, penne, Rao’s pasta sauce, parmesan cheese, Siggi’s yogurt, Purely Elizabeth granola, chocolate chip cookies, dark chocolate ice cream, apple pie, frozen supreme pizza, frozen fries, frozen broccoli, cold brew coffee, almond milk, sprouted bread, cooking utensils, and kombucha ($74.98 expensed).

7 p.m. — Head home and start baking the frozen pizza. Our plates will take a few days to arrive so we eat off napkins. We set up our mattress and bedding for the night and start to put our clothes away. There are so many more cabinets and closets than our old one-bedroom. We head to bed around 11. Tomorrow is the weekend, at last!

Daily Total: $2,721.13

Day Three

8 a.m. — We wake up and start getting ready for the day. I do my morning Peloton workout and eat yogurt, blueberries, and granola for breakfast. There are still a ton of home items we want to get so we head into town to one of my favourite places ever: Crate and Barrel. We get a seven-piece Wusthof knife set ($359.29), a beautiful Le Creuset dutch oven in cream with a gold handle ($395.11), and a John Boos cutting board ($135.20). I’m so excited to finally get one of these and try out some delicious recipes! We head to The Container Store next and get a laundry hamper ($64.90, why is this so expensive?!) and some drawer organisers for the bathroom and kitchen ($53.10). We also stop by Lush and get four bath bombs ($33.12). Our master bath has a beautiful freestanding tub that we want to start using. $1,040.72

12 p.m. — We head to my second favourite place ever, Costco. We get some grocery staples: six pounds of beef lasagna, frozen boba bars, frozen cauliflower pizza, frozen buffalo wings, frozen acai bowl packages, frozen beef bulgogi dumplings, Liquid IV, vitamins, and some candy ($184.20). We also get an 18-inch pepperoni pizza from the food court to eat for lunch ($10.77). $194.97

2 p.m. — We stop at home because we need to put the frozen items from Costco in the freezer. I browse CB2 and buy a matching nightstand and dresser set and use a 15% off coupon code ($2,542.70). Unfortunately, both of these items are backordered right now so it’ll probably be another month before they get delivered. I also browse Home Depot for Christmas trees. I pick one that’s seven feet tall and has programmable micro LEDs ($420.90). Technology these days! $2,963.60

4 p.m. — I start configuring all of the smart devices in the house. The house’s thermostats, light switches, and the Ring doorbell can all be configured on an app so I spend a few hours setting this up. My husband shops online for a new desk and office chair ($92 expensed from his company). I FaceTime my sister who’s currently in college and in the process of applying for internships. She’s studying computer science so I help her with her resume and give her tips on technical coding interviews.

8 p.m. — For dinner, we make a salad at home with cherry tomatoes, green peppers, parmesan, and baked chicken thigh. We unwind for the day by taking a bath with our new Lush bath bomb. We get into the mood and… you know. We fall asleep in bed quickly after.

Daily Total: $4,199.29

Day Four

8 a.m. — Today is Halloween! We go on a quick three-mile run. We love looking at all of the houses in the neighbourhood that are under construction. The neighbourhood is probably around 70% finished but we live in a newer section where most of the houses are still under construction.

9 a.m. — We stretch, shower, and eat breakfast. We like to cook bigger breakfasts on weekends since we have more time, so I make avocado toast with sprouted bread and a pesto egg. Delish! Our TV gets here so we spend a good four hours locating studs, marking drill holes, screwing in the mount, and figuring out how to lift the TV up to hook it onto the mount. After a lot of sweat and arguing, we finally get it done. If you want to test your relationship with your significant other, I suggest trying to mount a large, expensive TV together.

1 p.m. — Lunchtime! We go out to a local BBQ joint for some brisket, mac and cheese, coleslaw, and pork ribs ($33.15). BBQ is probably one of the best things about moving to Texas, besides the no state income tax, of course. $33.15

7 p.m. — We cook the frozen dumplings from Costco and watch the first episode of season three of You on Netflix on our new TV. The Sunday scaries are hitting hard. We talk about our plans for the week and we write down what we hope to accomplish (for work and our personal lives). I’m a huge advocate of planning; it keeps us organised and on track. Obviously, we are flexible for unexpected things that come our way, but this at least provides some structure.

11 p.m. — We head to bed. Mondays are our busiest days so we need to be well-rested. Goodnight!

Daily Total: $33.15

Day Five

7 a.m. — We take our car to the car shop for maintenance. It needs new rear brake pads and rotors, brake fluid, an engine air filter, and an oil change. This costs us a whopping $847.50. We plan on keeping this car until it dies, so we think it’s worth the maintenance cost. Also, the new and used car market is a bit insane right now. $847.50

9 a.m. — Quickly scarf down my typical breakfast of yogurt, fruit, and granola and get started on work. I have meetings all day today.

12 p.m. — I’m exhausted already. I’m a naturally introverted person so it takes a lot out of me to be talking to people for hours on end. I eat a quick lunch of penne and Rao’s (best pasta sauce ever, I could literally drink it straight) and jump back into meetings.

6 p.m. — Done with meetings for the day and starting cooking dinner. I keep my phone with me to answer any Slack pings that come my way. The majority of my team is on the west coast, so they’re still working.

8 p.m. — I’ve been thinking that I want to start getting into the hobby of making espresso so I browse the r/espresso subreddit on entry-level espresso setups. Apparently entry level starts at $1,000, which blows my mind. I pull the trigger and buy a Niche Zero grinder ($750), a Breville Bambino Plus ($559.20), an Acaia Lunar 2021 scale ($264.10, a bit ridiculous for a scale, I know), a Fellow Atmos Vacuum Canister ($31.20), and some accessories from Amazon (knock box, bottomless portafilter and single wall basket, WDT tool, distribution tool, and tamp mat ($89.24)). The Niche Zero grinder is super back-ordered and won’t get here until next month, which is a bummer, but apparently, it’s the best one out there. I also get the matte black Fellow Stagg electric kettle because it is stunning and a statement on the kitchen counter ($172.12). $1,865.86

10 p.m. — I’m exhausted from the day and start getting ready for bed. Lights out and I fall asleep instantly.

Daily Total: $2,713.36

Day Six

7 a.m. — Wake up and go on a four-mile run. Our neighbourhood has a ton of rolling hills and they destroy me. I arrive home huffing and puffing. I do a long stretch session and hop into the shower. Then I eat my typical breakfast (yogurt, fruit, granola) before I jump into meetings.

12 p.m. — Lunchtime! Eat yesterday’s leftover pasta. I check on my stock portfolios and decide to transfer $10,000 into my Wealthfront account. I’m terrible at picking individual stocks so I mainly buy ETFs, mutual funds, or use a robo-advisor like Wealthfront. Jump back into work.

2 p.m. — Our Christmas tree arrives! It takes five minutes to set up and it looks beautiful. I’m feeling the Christmas spirit already!

5 p.m. — My amazing husband cooks dinner today while I finish up the last few tasks for work. He makes an amazing Thai chicken curry with green peppers, onions and jasmine rice. So good. We watch two episodes of You. Wow, Love is so devious but such an interesting character at the same. We also watch an episode of Squid Game since it’s all the rage. The first episode was meh. Hopefully, the next one is better.

9 p.m. — We have a movie/entertainment room in this house, so I decide that we HAVE to have an antique popcorn maker. I buy an eight-ounce popcorn maker and popcorn seasoning ($284.54). My closet looks like a hurricane went through it, so I spend the next two hours folding clothes and organising them by type. Wow, so much better. $284.54

11 p.m. — Lights out. Goodnight.

Daily Total: $284.54

Day Seven

7 a.m. — Wake up and do a 40-minute Peloton upper body workout. My arms feel like limp noodles. Shower quickly and scarf down breakfast. Sign into the first meeting of the day.

12 p.m. — It’s a miracle that I have no scheduled meetings left for the day. We celebrate by going to a neighbourhood crepe place for lunch. I get a savoury crepe with avocado, sausage, cheese, and mushrooms and a sweet crepe with Nutella, strawberries, and bananas. My husband gets one with smoked salmon, capers, onions, and cheese. $25.35

3 p.m. — Our dining table arrives! Hooray for not having to eat at the island counter. We got a beautiful marble table from CB2 that seats six people, perfect for hosting friends and family.

6 p.m. — Eat leftover curry for dinner and watch another episode of You. We start looking into garage floor epoxy services since we want to finish our garage floor before we put any workout equipment on it. We get a couple of quotes ranging from $3,000 to $6,000. We schedule one for two weeks from now but payment isn’t due until they complete the service. The one we settled on costs around $4,000 for a three-car garage.

9 p.m. — We start looking into home gym equipment. We decided on a power rack from Rogue Fitness, a barbell, a 400-pound set of bumper plates, and a bench. We decide to order this now since it’s back-ordered and won’t get here until after the garage floors are done ($3,584.25). We also need to look into rubber mats and a deadlifting platform. $3,584.25

11 p.m. — We decide it’s enough spending for the day and call it a night. We realise that we’re definitely spending more than usual since we just bought a house and are trying to furnish it and turn it into everything we hoped for. I tell myself that once we’re all settled in our expenses should go back to normal.

Daily Total: $3,609.60

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behaviour.

Like what you see? How about some more R29 goodness, right here?

Money Diary: A 28-Year-Old Voice & Accent Coach