Welcome to Money Diaries, where we tackle the ever-present taboo that is money. We ask real people how they spend their hard-earned money during a seven-day period — and we track every last dollar. Do you have a Money Diary you’d like to share? Submit it here.

Today: an instructional designer who makes $81,500 a year and spends some of their money this week renting rock climbing shoes.

Content warning: This article touches on instances of disordered eating that some readers may find upsetting.

All currency is in AUD

Occupation: Instructional Designer

Industry: ICT

Age: 30

Location: Homebush, Sydney

Salary: $81,500

Net Worth: $200,300 ($16,000 in savings, $64,000 in super, $2,300 in my Raiz investment account, $118,000 in home equity (shared with my partner)).

Debt: $435,500 ($432,000 on my mortgage (shared with my partner), $3,000 in university debt, and $500 on my credit card).

Paycheque Amount (Fortnightly): $2254.61

Pronouns: They/Them

Monthly Expenses

Mortgage: $1,639, split with my partner. We live in a one-bedroom apartment in Homebush, Sydney.

Fees: $250 for strata, council, and water fees.

Utilities: $180. It’s usually a third of this and I get ‘free’ savings.

Internet: $40

Car Insurance: $50

Pet Insurance: $45

Health Insurance: $100

Phone: $55

Netflix/Stan/Binge/Disney+/Spotify/Prime: $95 (I split a lot of accounts with friends!)

Cat Food and Litter: $95

GoGet: $40

Therapy: $120

Medication: $10

Savings Contributions: $450. I also use Raiz to round up transactions to the nearest dollar and invest the difference.

My partner and I have a joint account that we only use for our home loan and strata, council, and water bills. For everyday expenses like groceries, utilities or splurges, we just split it in BeemIt.

Did you participate in any form of higher education? If yes, how did you pay for it?

When my siblings and I reach Year 6, my parents told us that we could either go to a private high school, or have our HECS paid for by them. As a result, my parents paid for my Bachelor’s degree. Looking back, it’s a bit weird that they trusted us with that choice when we were like 11. But I guess they wanted us to learn about making financial decisions. We all chose to have our HECS paid for, plus my paternal grandparents helped them out. I also have a Graduate Certificate I that I paid for using some inheritance from my grandparents. I’m currently paying for my Masters with my own savings as it’s only $1,500 a semester for two years.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

Both my parents have worked in finance so we had many frank conversations about money as far back as I can remember. Instead of getting physical pocket money when we were kids, we had a ledger that my mum kept for us so we learnt about money-in and money-out. My parents really wanted us to be financially literate — my mum’s dad lost a huge amount of money in his life and was constantly in debt, so I think that was a bit of a motivating factor for them. On the other side, my dad’s parents grew up in the Great Depression and were obsessed with saving money. They weren’t unusually wealthy (they were a builder and a stay-at-home mum) but they were good at investing and lived a very frugal life, so they left us all a very generous amount. But at the same time, my grandmother wouldn’t pay for takeaway so she died without ever trying Indian food, despite wanting to. I think there’s a happy medium in there.

What was your first job and why did you get it?

My parents wanted us to get a job as soon as we could so we could learn about financial responsibility. When I was 14, I had a six-week summer job at a local hairdresser. When I turned 14 and 9 months, I got a job the next day as a waitress. I stayed in that job for the next 6 years.

Did you worry about money growing up?

Yes. We had periods of being quite well off, but when I was 10 to 15 years old, Mum couldn’t work due to illness. As a three-kid household, we struggled financially. I remember hearing quiet conversations about the accounts being empty at the end of the month, and I remember how my mum would react if we ruined something we owned, like a shirt. My parents are very well off now, but that period casts a pretty big shadow over how I view money.

Do you worry about money now?

I probably don’t need to as much as I still do. If I have to take money out of my savings, I basically have a panic attack. I do feel conflicted sometimes — part of me wishes I had more of a savings buffer, but I also don’t regret spending money on meaningful things like travel and study. I also wish I earned enough to work four days a week as I think it would be better for my mental health, but I have no idea when, if ever, it will be something I can afford. I’m at least glad we don’t want kids, so we won’t have to worry about that expense.

At what age did you become financially responsible for yourself and do you have a financial safety net?

I was lucky to have parents who were happy for us to stay at home while we studied and saved. I moved out just after I turned 23, at which point I became fully financially responsible for myself. My parents are my safety net — I know they’d always help me if I needed it.

Do you or have you ever received passive or inherited income? If yes, please explain.

I received $80,000 from my grandparents when they died, and my parents gave me $100,000 for a deposit on an apartment.

Day 1

9:00am — It’s Saturday morning and I couldn’t be more relieved to have a sleep in after going out to dinner last night. Since I had Covid, everything wipes me out, but at least I’m sleeping like a rock. I read in bed for half an hour before getting ready to head out.

10:30am — Apartment viewing time! My partner and I are thinking about selling our current one-bedroom apartment and finding a two-bedder instead. I work from home permanently, so it would be great if my home office didn’t occupy half our living room (lofty dreams for a millennial couple!). It’s early days and we’re interested to see if we can afford to move a little bit closer to the train line. We head to our neighbouring suburb to see what our money will get us. It’s very disappointing compared to what we can afford in our current suburb. The first apartment we see is dark and poorly kept, with no window in the second bedroom. My partner doesn’t mind it, but I’m pretty sure if I started spending eight hours a day alone in a windowless bedroom, I’d have a breakdown. I decide to place ‘second room window’ in our must-have’s list.

11:10am — We have an hour between viewings, so we sit down for brunch near the next place. I have a chorizo and potato hash and an iced almond latte ($19). My partner has halloumi fritters and a juice ($17). I pay for it all on my card and chuck it in our BeemIt account to split with her. I use a budgeting app to keep track of my daily expenses, so this system is easier for us than having a joint account. $36

12:15pm — The next apartment is even more depressing. This time, it’s because it’s amazing… and about $120,000 out of our price range. It’s good to know what we’d have to spend for our perfect place, and we adjust our expectations of what we can actually have accordingly.

12:30pm — It’s incredibly hot outside so we decide to head home, but first I need to stop by Woolworths. A friend is coming over later, so I need snacks and dinner supplies. I’m doing a gluten elimination diet to check for a wheat allergy (uuggghhhh!), so cooking is a bit easier than ordering in. I grab gluten-free gnocchi, cherry tomatoes and asparagus to make the world’s easiest pan-fried pasta, as well as some chips and fruit. We also keep seeing things we haven’t been able to find at our local Coles — a brand of chocolate I like, the shampoo my partner needs, some fancy sausages — so it ends up being a bigger spend than I expected — $32 each. $32

2:30pm — My friend comes over and we make caramel apple cocktails with the supplies she has brought. The two of us usually marathon The Lord of the Rings annually, but here’s where I admit that neither of us has rewatched The Hobbit since we saw it in cinemas. So today, we’re watching The Hobbit numero uno. Alas, it’s about as average as we remember. We spend the last half hour of it discussing her new job and not paying much attention.

7:00pm — I cook us gnocchi with the groceries from earlier, and we split a bottle of nice wine I bought last month. I thought I’d have an early night but we end up sitting on my building’s roof garden drinking wine and getting angry about heteronormativity… and suddenly it’s 11pm. She heads out into the night and I fall into bed beside my partner who’s already asleep.

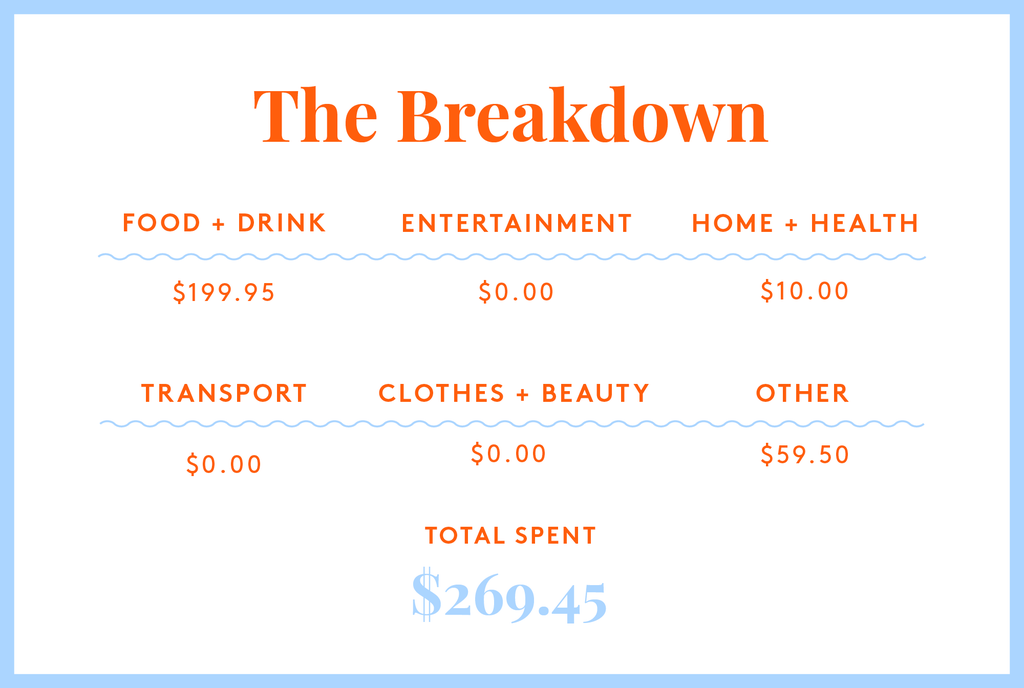

Daily Total: $68

Day 2

8:00am — My cat wakes me up, so I read for a bit (Gideon the Ninth — necromancers in a haunted palace in space!). We usually see my partner’s family on Sunday mornings for breakfast, but they’re all out of town this weekend so I get to lie in.

10:00am — I really need a nice big coffee after last night, so I head out to get an iced almond latte from the local cafe ($6). Post-viral recovery and a bit of a hangover are a hell of a combination. I come back and decide to do as little as possible today. $6

12:30pm — I am too sleepy to do much about lunch, so I eat some plain rice crackers from the pantry and some blueberries leftover from last night.

4:30pm — My partner suggests we go for a walk to wake ourselves up. We walk to our local Asian grocer because she wants to get a milk tea, and I discover they have whole coconuts ready to drink, which I am powerless to resist. I grab one and she buys it along with her tea and a bag of small fruit jellies. She tells me not to bother about the $7 expense — we usually don’t bother splitting things under $20 total. We walk down to the riverside and eat the fruit jellies while watching a pelican, but it’s too hot to stay out for long.

6:00pm — On Sunday nights we have dinner with my family. My parents are away, so we go to my sister and her husband’s house to play Switch games. We order pizza for dinner ($16 each — mine is gluten-free), and I grab a side salad to have instead of the garlic bread everyone else is sharing. It’s a nice salad but it’s no garlic bread. If I’m allergic to wheat, I’m going to throw myself into the sun. $16

8:30pm — I’d love to stay and keep playing Super Mario Bros but my partner has to be awake at 6:30am tomorrow so we call it and drive home.

Daily Total: $22

Day 3

8:00am — I make myself a coffee and sit down at my computer to work. My company was fully remote even before the pandemic, although I only started with them last year. I love not having to commute, but I miss my podcast time. I also worry about how little I walk these days. I’ve been thinking about getting an under-desk treadmill, which seems silly given there are plenty of nice walks in the bushland near my home. But I rarely take the time to actually leave and go walking, so maybe I need to just accept who I am as a person and make my choices accordingly.

11:15am — It’s time for coffee number two, and I decide to buy it from my local cafe. I want a screen break, plus the supermarket is a three-minute walk away so I figure I can also get some groceries while I’m at it. I go get dinner supplies first (curry spices, chicken, and miscellaneous veggies) and a couple of lunch items (falafels, salad leaves, and a few soups) for the next few days and split it in BeemIt with my partner ($24.30 each). I then grab a large coffee ($5) and return home. $29.30

1:10pm — Lunch is leftover salad from the night before, which is surprisingly still edible given how heavily it was dressed. I add some falafel I picked up at Coles this morning.

4:00pm — I’ve been looking at changing health insurance companies because I’ve been sent to an exercise physiologist, which my current insurance doesn’t cover. It’s really hard to find one that covers it on a plan I can afford, and it looks like my best option is to increase my premiums by about $20 a month — annoying, but it still saves me money overall. I mention this because I’ve just noticed that all my internet ads are now for health insurance. Cheers, technology.

6:30pm — For dinner, I make chicken and tomato curry with supplies from my morning shop, which turns out better than expected. I do most of the cooking in our house, and my partner does most of the cleaning. To me, cooking doesn’t feel like work, I find it relaxing — and she feels that way about cleaning. We don’t really measure who spends more hours on what household task, we just try to make each other feel recognised and appreciated for what we do. Saying a quick thankyou for every meal and every vacuum is easy, but it goes a long way. Sometimes she picks up the slack, sometimes I do — as long as the lines of communication are open, it works pretty harmoniously.

9:00pm — Time for a bit of mindless internet scrolling before sleep.

Daily Total: $29.30

Day 4

9:00am — I struggle to eat breakfast as I’m never hungry in the morning, but if I don’t, I end up overeating at lunch — all my homies with a history of disordered eating in the club tonight can I get a ‘hell yeah!’? I have for many years struggled with a delightful combination of OCD (restricting food, bingeing forbidden goods, panic attack, rinse, repeat) and gender dysphoria (if I put on weight I look more identifiably feminine so that’s to be Avoided At All Costs). In 2020, I went back to therapy to have a stab at not hating myself and two years later I am so much happier and at peace with my body, buuuut mental illness can be for life. Now I have to actively make good and healthy choices every bloody day or the brain gremlins will take over. So here I am, forcing down my daily breakfast item, because sometimes self-care is angrily eating a muesli bar like a toddler facing a bowl of broccoli.

11:00am — Because my job is remote and the hours are flexible, I can step out during the day for errands. My two cats are recovering from a stomach illness and are currently on a special food diet, so I walk down to the local vet to pick up some more, as my online order still hasn’t arrived. I grab just enough for three more days ($22.50), by which point it should be here. These cans of food are twice the price of what I normally pay for their food, so it’s an added pressure on my budget. Worth it for my children. $22.50

11:10am — Having said that, I am still going to buy my second coffee today ($5). Not everything is about you, kids.

1:00pm — Lunch is leftover curry from last night, which I manage to spill on my shirt. It’s hard to detach from work when you eat lunch a metre from your desk, so I only take about 20 minutes. I’m in the middle of editing some training videos, which I am also starring in, and having to listen to my own voice all day is a unique kind of hell. I am thus motivated to charge ahead and reach the finish line.

3:15pm — I realise in my single-minded focus on providing for the cats this morning, I forgot to go to the chemist to pick up my own meds (if you can’t make your own serotonin, store-bought is fine). I decide to duck back out, since it’s two minutes away, and thankfully the chemist is empty and the whole thing is very fast ($10). The wonderful thing about Homebush is how everything you need is within walking distance. Not everyone is keen on the artificial landscape of high-rise apartments and man-made garden beds, but it reminds us of Singapore, which both of us fell in love with when we visited. Plus, there’s a bird sanctuary over the road which is *chef’s kiss* for a nature nerd like me. $10

6:30pm — I make miso eggplant poke bowls for dinner from the groceries I bought on Monday morning. A few months ago, we started using sushi rice every time rice is called for. My god, it makes a difference. Every other kind of rice can get stuffed (except you black rice, you’re perfect too).

7:30pm — It’s a brain dead kind of evening. We put on something we don’t need to pay full attention to — Parks and Recreation. We’ve seen it a thousand times, so my partner can crochet and I can play Animal Crossing.

Daily Total: $32.50

Day 5

10:00am — I’m going out tonight, so I decide to skip buying coffee number two to make sure I have a healthy budget for dinner and drinks. I make it with my coffee machine instead. It’s never as good. I recently switched from a Nespresso pod-based machine to a Breville barista machine because I hate Nespresso’s milk frothers. I am enjoying the ritual of making coffee rather than the machine doing everything, but man I wish I could produce a better cup. I strongly suspect I haven’t quite found the right beans yet.

10:30am — I finally finish editing some work videos that have me in them. No more listening to myself speak and wondering why I move my mouth like that. Bliss.

12:45pm — There’s one serve of tomato curry left, so that’s lunch sorted again. I am over the curry at this point. My therapist wants me to try and eat lunch on my balcony instead of in my living room (because my living room is also my office), but it has been way too hot and humid to do so. Plus, if I go outside, the cats come too, and then I have to watch them and make sure they don’t start chowing down on one of my partner’s 32 plants. Why not just leave the cats inside, you ask? Partly because I feel like I’m betraying them, and partly because it’s very hard to enjoy lunch when two tiny demons are yelling their lungs out at you from behind a pane of glass. I put it in the too-hard basket, send a mental apology to my therapist, and eat lunch on my couch while browsing Reddit.

7:00pm — My friends and I have been going to the same pub trivia in the city for three years now — during lockdown, we even moved it online. We don’t really love the pub itself, but we love our trivia master, and we cannot bear to leave him. Plus it’s really nice to have a standing arrangement to see friends, which gets harder as we get older. We did terribly last week, but it was the first week back after a few months, so we were very rusty. We’re hoping to redeem ourselves tonight. I grab the daily steak special and a glass of rose ($27.65). $27.65

9:00pm — We came third! I have a second glass of wine, and buy one for a friend because I owe her from last week ($28). We also win a jug of beer because I know more about Brendan Fraser than I should. The gays love Brendan Fraser. $28

9:20pm — Time to head home. My teammates all live within 15 minutes of the pub, whereas I’m further out, so it takes me a bit over an hour to get home. I grew up down the street from a train station which meant the parental lifts dried up fast as a teen, so I generally enjoy train commutes. But by 9pm, I kind of want to be home and thinking about getting into bed, so I’m always tired and impatient after my post-trivia commute, especially in this humidity. Plus my partner is usually asleep when I get home, which makes me sad. Not to be cringe, but I do not sleep as well without a bedtime cuddle.

10:40pm — I’m home, and my partner is in fact asleep. A few weeks ago I put a dollar in a claw machine while wandering through Capitol Square and somehow won a large Snorlax plush toy (this is not a sentence I expected to write) so I fall asleep clinging to him instead.

Daily Total: $55.65

Day 6

9:30am — It’s possible that three drinks on a Wednesday are three too many for mid-week, so I’m having a slow morning at work. I feel like I haven’t really woken up, but I can’t be bothered to go get a coffee, so I make my own to have with my muesli bar.

11:00am — I find out this morning that work is going to start training me to learn HTML, which is awesome. I generally focus on developing training content and resources, but this will open up some new training tools and platforms for me. Plus, I’ll finally know what the dev team are talking about at any given moment. I am a bit of a magpie for skills, so am very keen to get started next week.

12:30pm — Lunch is some lentil soup I bought on Monday. It is decidedly not soup weather, but I blanked on gluten-free lunch options while I was shopping. I’ve made my soupy bed and now I must lie (swim?) in it. Once again, I’m going to eat inside. Not every choice can be a winner.

3:00pm — Today is going slowly. I’m working on developing a new custom training course for a client, and it’s early in the process so I’m taking the rough outline from our Figma board and building it out in a Powerpoint deck. I like to throw everything down first, then do a few iterations of getting feedback and refining. Thankfully, my boss works the same way, so we’re a really good match.

5:30pm — My friend and I have a Spanish class with a tutor on Zoom ($30). My partner is South American and I started learning so I can speak with her relatives. I’ve never been particularly good at languages, but it’s fun at least. I find in social settings when I try to speak Spanish to people my whole brain freezes and I forget every word I’ve learnt, but at least my listening skills are picking up. We’re currently learning how to speak in past tense, which is very exciting, as up until this point I’ve only had a grasp on present tense which makes me sound a bit like a Sesame Street character. $30

6:30pm — Class is finished so I throw on some lemon chicken zoodles from the groceries I bought on Monday. My partner and I eat dinner while watching the Winter Olympics ice skating. We are not big sports people at all, but during lockdown last year, we got really into the Olympic climbing, diving and skateboarding, so I guess this is a thing we do now. The ice skating is incredible, and we spend most of the time yelling variations of “HOW IS THAT POSSIBLE?!”. Both cats leave the room.

Daily Total: $30

Day 7

8:00am — I start work feeling full of beans, because it’s Friday, and because I don’t have any meetings today. I really love being left to my own devices to work on developing content.

10:30am — Friday morning is definitely a barista coffee morning ($5). Some Fridays I have a croissant as a treat (a local cafe has the freshest and butteriest ones you can imagine), but not today, because gluten. Depresso. When I arrive home with my coffee and a side of sadness, I remember I’m in desperate need of doing a load of laundry, which is my least favourite house task. Unfortunately, my partner also hates it. We’re very happy with monogamy, but our running joke is that our ideal third partner is just someone who likes laundry. Unfortunately, we both have a tendency to forget we’ve put a load on, leading us to find it smelling gently of mildew in the machine the next day. Beginning a laundry cycle is fraught with peril, but I bite the bullet and throw my clothes in before returning to my desk. $5

12:30pm — Lunch is the rest of the soup. Why did I do this? As a treat for my brain, I decide to open the balcony door and sit on the doorstep to eat in the fresh air. The minute the door opens, the cats practically hurl themselves past me to enjoy the fresh new aromas of the outside world. It takes about three minutes for one of them to try and take a bite out of a peperomia, which I narrowly avert. This is not relaxing, and after 10 minutes I give up and take everyone inside.

5:30pm — My partner and I started bouldering last year, but it’s been pretty stop-start due to Covid (and a sprained ankle on my part — don’t slip off the top of the wall, some free advice for you). Because of this, we still haven’t bought our own shoes, so we rent a pair ($7 each) and say for the twentieth time “We really need to go get our own shoes”. We each bought a 10-pack of bouldering sessions late last year for $180, so I use one of those for entry. It’s my first time back after recovering from Covid, and I actually complete several routes — way better than expected given how exhausted I still get walking up stairs. It’s a great boost to my general mood. $7

7:30pm — While driving home, we order dinner from our local Thai food place. Normally we both get fried chicken poke bowls, but this gluten-free elimination diet means I end up with a satay chicken curry situation. It’s good, but not as good — which seems to be a recurring theme with eating gluten-free. I can’t believe some people do this out of choice. We split the expense ($20 each). It arrives right when we do, how’s that for efficiency? We collapse on the couch with our food and some more ice skating. $20

9:00pm — After showering and climbing into bed to read, I remember the laundry is still sitting in the machine. God dammit.

Daily Total: $32

If you are struggling with an eating disorder, please call Beat on 0808 801 0677. Support and information is available 365 days a year.

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behaviour.

Like what you see? How about some more R29 goodness, right here?

A Week In Hawaii On A $150,000 Salary