This week: “I’m a 32-year-old growth manager (essentially a performance marketing manager) living in London with my boyfriend and our cat. We bought our flat in June using the Help To Buy London scheme and the stamp duty holiday – we could not have done it without these (and family help). Before the pandemic I was working in a similar role in an industry I enjoyed but lockdown meant that I had to find a new job before I was made redundant and I ended up in a role which just isn’t for me.

Luckily I am starting a new job in three weeks! Almost all of my savings are from the past three years, where I have been earning more (and spending less due to COVID). These savings were always for my first home but then I was gifted the deposit money so I plan to use a fair chunk when we refinance in four and a half years. I’m both a saver and a spender; I could probably save a lot more but I like going out to eat, buying clothes and I spend a lot of money on gym classes.”

Occupation: Growth manager (currently working my one month notice)

Industry: Digital health

Age: 32

Location: SW London

Salary: £60k

Paycheque amount: £3,224

Number of housemates: One boyfriend, one cat

Pronouns: She/her

Monthly Expenses

Housing costs: £949 mortgage, which my boyfriend pays as I paid the flat deposit (with money gifted by family). He is paying the mortgage until we are ‘even’. He decided to do this – I said since the money was gifted I didn’t expect him to repay me but he wasn’t comfortable with it. I’m saving the extra money and I will use this for refinancing and/or paying for our wedding one day.

Loan payments: £300 student loan taken from my paycheque. We have £400 outstanding on a BNPL deal for our bed, which needs to be paid by the end of March.

Savings? £3,777 in a Moneybox stocks and shares ISA, £14,061 in a Fidelity stocks and shares ISA from last year when I started saving this way and £1,336 in a Monzo savings pot which I dip into if I need to and add my monthly savings to until I transfer some to Moneybox.

Pension? I have an auto-enrolment pension. I pay 5% and my employer pays 3% (my new role I believe is matched at 5%). When I leave I will transfer it to my PensionBee, where my other pensions are. There is about £20k in there, which is a huge source of stress for me as there is no way this is big enough.

Utilities: I currently transfer £500 to the joint account and my boyfriend transfers £1,500 which covers all shared costs, including: £256 council tax, £52.05 life and critical illness insurance, £43.87 internet, £9.10 Smol, £10.76 pet insurance, £60-£80 gas and electric, £7.99 Deliveroo plus, £188 water per half year (based on our last bill). We also pay £1,600 per year service charge so we put some cash aside monthly.

All other monthly payments: £45 O2 contract. £26 Who Gives A Crap toilet paper every two or three months. Subscriptions: £155 gym membership, £10.99 Frame on demand, £23 Dermatica, £7.99 Audible. I also pay my brother £4.25 a month towards a family Spotify plan.

Did you participate in any form of higher education? If yes, how did you pay for it?

I went to university for four years but my third year was a working placement year. I had the basic tuition fee and maintenance loan for the time (2007), which totalled about £6k per year, and my dad covered my rent. I didn’t work in the first year but I worked the rest of the time.

Growing up, what kind of conversations did you have about money?

I was never educated about finances which is frustrating because I would ask. I grew up pretty well off – I never really wanted for anything but I wouldn’t say I was spoiled, apart from the time around my parents’ divorce when I was 14, when they would buy me loads of stuff to compensate for a difficult home life. We went on a lot of foreign holidays and had two cars. My mum didn’t work while my brothers and I were in primary school and then worked as something to do rather than out of necessity. My dad’s business dried up a while ago but he was smart with money so has a pretty massive pension and savings funds from what I understand.

If you have, when did you move out of your parents’/guardians’ house?

I moved out at 18 for uni and returned for six to nine months afterwards while job hunting and until I could afford to rent in the city nearby. I returned home at 25 for three months after losing my job to sort my head and my life out.

At what age did you become financially responsible for yourself? Does anyone else cover any aspects of your financial life?

This is a difficult question. My dad has always been there to give me a boost. I moved around a lot and he’d often pay my rental deposit and not expect it back (though I would try to). I was given £30k this year by my dad and stepmum to buy a home, which I could not have done for a few more years without them. I will not take any more from them now.

What was your first job and why did you get it?

Working in a high street shop at 16. I was expected to get a job and was marched up and down the high street by my mum until I got one. I worked there until I left for uni.

Do you worry about money now?

Not day to day but we owe a huge amount on our flat (we took a £275k mortgage and a £200k equity loan) and I get very stressed at the thought of refinancing in a few years.

Do you or have you ever received passive or inherited income?

£30k gifted by my dad and stepmum, and about £11k as part of a settlement agreement when I lost my job in unpleasant circumstances. This paid off some credit card and student overdraft debt, the contract on my rental agreement at the time, a down payment on a car loan and kept me going until I got a new job.

9am: Wake up and make toast for breakfast. We accidentally bought regular butter instead of light and it’s so delicious.

12pm: J still isn’t awake so I make some lunch, which is a combination of leftovers and frozen things. I hate food waste so I will eat some odd things.

2pm: Finally the beast has awoken and we walk into town, which takes about 25 minutes. J has taken on a huge walking challenge so goes into a closing down sale for an outdoors shop and I go into Anthropologie, which he hates. I have a nice browse and end up getting a decorative plate for a friend. It was her birthday last week and it is just so ‘her’ that I have to get it. £14

2.30pm: I meet J at the till in the outdoors shop and then we stop in at a shake shop because I love me a froyo. I pay for both of us. £9.38

3pm: Last shop in town is Wilko. I love Wilko usually but this one is a bit of a dud. I still manage to spend £38.50 on a bunch of bath stuff and some candles, bulbs and batteries. I pay because I can’t be bothered calculating what’s ‘mine’ and what’s ‘ours’ and tell J he can pay for my drinks tomorrow night.

3.15pm: Stop in at Sainsbury’s for some parsley and eggs for a kedgeree this evening and grab an iced tea for J who wants “a really wet drink”. £2.30

6pm: J is too engrossed in a war show on Netflix to cook, even though he knows he makes a much better kedgeree than I can. I cook and neither of us enjoys it, which is annoying because it’s probably my favourite dinner.

10pm: I’m having an early night tonight as I have work tomorrow. I got an exciting job offer last week, which is amazing, but my anxiety over talking to my boss gives me a crappy sleep.

Total: £64.18

8am: Wake up, check my phone and see I’ve been reimbursed by work for my eye test a few weeks ago. It’s the day before payday and I have £50 left in my account, which I transfer to my Amex to go towards a bill. The balance is a little higher than usual this month as I put my Botox spend on it (£320 a few weeks ago). I go every five months or so for crow’s feet, elevens and forehead injections.

9am: Log on and have a mild panic attack at the thought of speaking to my boss. He messages me about something so I ask if he has five minutes (everyone knows what that means). He takes it really well and totally understands my reasons (the ones I shared with him at least).

10am: Time for an anxiety walk to blow off some steam. When I get home I see a very sweet Slack message from my boss’s boss. It makes me feel so guilty as my teammates are absolutely wonderful, the job just really isn’t fulfilling me and I’m frustrated all the time.

12.30pm: I’m supposed to be at a gym class but I cancel it in time to miss the £2 charge and do a Frame online workout instead. My gym classes are really hard and after last night’s horrible sleep I need something much more gentle.

5pm: I start pestering J about what to do for dinner. We’re off to a comedy night tonight which starts at 7.30pm and the pub doesn’t do food. He ends up making some pasta with pesto and we walk down to the pub.

7pm: J pays for our drinks as I paid for everything yesterday. It’s a really cheap pub but the drinks aren’t the best.

10pm: The comedy was great. It’s such a bargain as it’s where comedians practise a lot of their stuff. It can be quite hit and miss but the misses can be really funny too. J insists we get a cab home because it’s freezing. I’d have been happy to walk so he pays.

Total: £50

8am: Wake up and it’s payday! I immediately start organising my money. I send £100 to a friend to go towards a hen do she’s organising, then pay the last £300 off on my credit card. My salary is paid into Monzo and our joint account is a Monzo account – it makes organising my money so much more simple than a traditional current account.

11am: Time for my morning anxiety walk. I take breaks at odd times but since I work from home, nobody really notices (or cares). I end up in Sainsbury’s where I spend a small fortune on liqueurs and spirits to stock up the home bar and make some cocktails this evening. I send a Monzo split request to J, which he immediately pays. £21.52

12pm: Another lunch of ‘what do we have in the fridge?’ There is some leftover couscous and salad so I make a massive chicken salad. I have a call with a brand I’ve been put in touch with. I fell into a freelance opportunity before Christmas so have tried to find some more but I think it’s too time-consuming to keep doing long term. We agree on a £750 project, which will take me about two weeks in my free time.

3pm: Do some sneaky potato peeling on an afternoon break for the mash this evening. I put them on to boil and do another quick Frame online workout, a bit more intense today with weights.

5pm: J is making a parsnip puree to go with some haggis. He says he needs cream so I pop to the Londis over the road. £1.50

7pm: Our friends arrive and say they’re surprised by how much they like the haggis. I serve the cocktails but stick to two drinks as I have to get back to the gym tomorrow and don’t want to be hungover.

12am: Time for bed. I have a quick Amazon browse and get a payday treat of a facial ice roller. £15.99

Total: £439.01

8am: Usual toast for breakfast and a cuddle with the cat while watching TikToks.

11am: Have a work call to discuss some issues we’re having on a project and brief my colleague on some work she’ll be picking up when I’ve left. All good spirits, I feel horrible again to be leaving because the people really are just so nice.

12.30pm: Finally back in the gym, we’re doing snatches. I hate snatches. I swear my arms are disproportionately short. I struggle through but I’m always so happy I’ve gone. I pop into Superdrug on the way home for some beauty blenders and vitamins, £18.63. I then pop into M&S for some eggs, £2.10.

1pm: A £15 charge comes out for a new marketing subscription I’ve joined. My free trial has just ended but I decided it’s worth the money to keep.

3pm: As I’m texting with friends to confirm weekend brunch plans I realise the restaurant is near a Frame studio and there is a rebounding class I can make before we meet so I book myself in. £12

7pm: We have dinner and J hints that he wants a night on his own since we’ve been so busy socialising this week (compared to our hermit life for the last two years). I leave him to play video games and listen to gloomy music and I go for a bath and watch a few episodes of Dexter: New Blood. It was a slow start but it gets really good!

11pm: I get everything ready for tomorrow as I’m in the office. I then get into bed and end up watching TikToks. It is such a bad pre-sleep habit but I have misplaced my Kindle.

Total: £47.73

7am: I’m up early today as I’m in the office for the first time since late November.

9.45am: The commute wasn’t actually that bad, I guess a lot of people are still staying home. I obviously forgot my entry pass so the office manager lets me in as I apologise. I spy the bottle of champagne I was gifted from a supplier for Christmas and quickly pop it in the fridge for later.

11am: Coffee with the boss went well. I was completely honest with him about my reasons for leaving and he totally understands. Boss pays for the coffee and we head back to the office.

11.30am: My GP calls. We have a chat about some issues I’ve been having where I basically wake up choking. He’s given me an inhaler to see how I get on as he thinks it could be asthma.

12.30pm: The office is next to an incredible food market so a few of us head over. I end up with a veggie poke bowl for £7.90 which I eat back at the office, having a catch-up with colleagues.

4pm: J sends me his sponsorship page for the walking challenge. I completely rewrite it to make it more emotive and he posts the changes. The charity supports victims of human trafficking. I’m so proud of him – it’s an eight-day mountain hike and I never expected him to do something like this. I withdraw £100 from my savings and donate (£101 with the admin fee).

6pm: The day actually went really quickly. I find days in the office can be quite tough when I’m so used to my own schedule but it was a really productive day. As soon as it hits 6pm I crack open the bubbles. I get a funny look from the CEO when the cork pops but hey, I’m leaving!

11pm: It’s definitely home time. I walk back to the station and get the train home in good spirits, listening to my favourite ’00s emo playlist on Spotify.

12am: I chug a Dioralyte and get into bed.

Total: £108.90

9am: Wake up as I’m due to log in. Not feeling so fresh but the Dioralyte has helped. My first meeting of the day is cancelled so I have an easy morning. My phone pings as £11.30 comes out for my contactless travel payments yesterday.

11am: I get out for some fresh air and errands. I pick up my new inhaler from Boots, £9.35. I then go to M&S to pick up a lazy dinner of chicken kiev, mash and veg, £8.25 for my half of the Monzo split. I then nip into Poundland for some cleaning products, £4.

12pm: Have Super Noodles for lunch, I should be ashamed but I’m not. I put peas in so it’s HEALTHY. Browse TikTok (again) and see one about propagating plants which I really want to do so I buy the recommended rooting product from Amazon. £4.50

5pm: Time for the gym. It’s clean and jerks today, which I find so much easier than snatches. I then head home to chuck dinner in the oven and finish The Puppet Master on Netflix. I was disappointed by the ending but it was okay.

8pm: Have another bath ready for an early night as there are no trains on tomorrow. I get everything packed for the morning, finish Dexter: New Blood and get into bed.

Total: £37.40

8am: My alarm was set for 9.30am but I wake up naturally. I rarely sleep super late as I tend to go to bed quite early. I have some toast and chill for a bit while checking all of my annoying options for getting into London.

9.30am: I wait 15 minutes for the rail replacement after just missing one and sit on the bus for 30-40 minutes listening to Invisible Women: Exposing Data Bias in a World Designed for Men on Audible. I can’t remember who recommended this to me but it’s fascinating.

10.20am: I’m finally at a train station but have a 10 minute wait for the train so I grab a ‘protein’ bar from Costa, £2.75. I take the train, then a Tube, then a short walk to Frame where I’m super early.

12.30pm: Rebounding done and I’m showered and getting ready for brunch. I didn’t want to pack a towel so pay £1 for one at reception as I’m not a member. I forgot how much I hate getting ready in gym changing rooms. I can never cool down properly so sit with the hairdryer set to cold on my face for ages.

1pm: Meet my friends for bottomless brunch, which is a set price of £47.81 with tip. It’s a really good deal for 90 minutes of prosecco and two plates of food. The manager offers us an extra bottle after our time has run out to leave a Trip Advisor review, which we happily do as the place is great.

4.30pm: Not really sure how a 90 minute brunch led to three and a half hours but it was great to catch up with these friends. I take a train to a nearish town to home and then a bus. My travel costs will show on my card tomorrow.

6pm: I’m home and J has bought a Charlie Bigham pad Thai for dinner so requests £7, which I transfer on Monzo. I wolf it down and promptly fall asleep, straight after agreeing to a gym class for the morning with my neighbour.

Total: £58.56

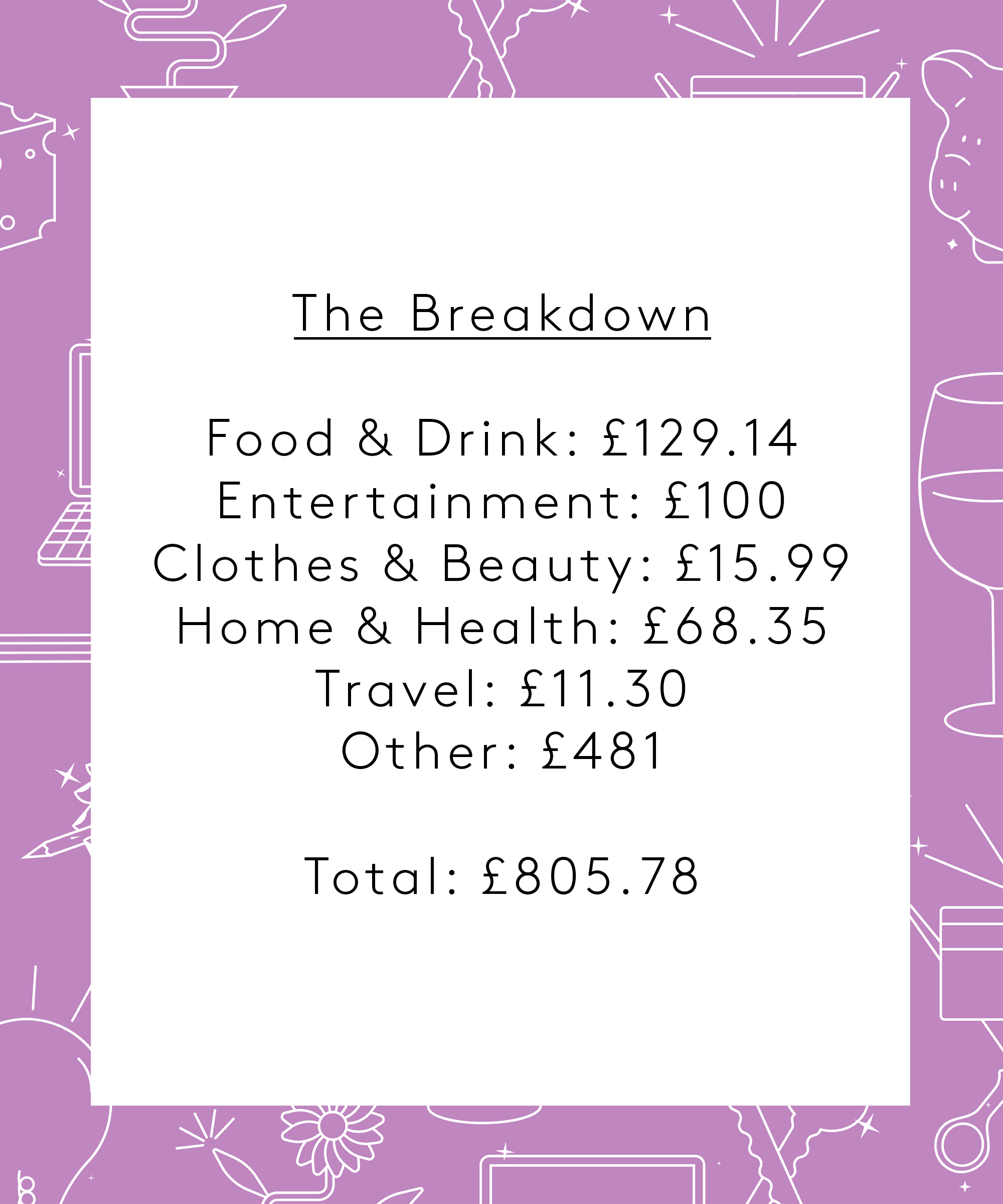

Food & Drink: £129.14

Entertainment: £100

Clothes & Beauty: £15.99

Home & Health: £68.35

Travel: £11.30

Other: £481

Total: £805.78

Conclusion

“This is absolutely shocking but I had a lot of payday outgoings included such as the hen do, paying off my credit card and the charity donation. If you ignore those spends, it’s quite reasonable I think. Working from home has saved me so much in commuting costs. I probably won’t change anything in the future, I think I have my finances pretty well organised. I also don’t usually drink as much as I did this week and won’t be drinking at all next week to compensate.”

Like what you see? How about some more R29 goodness, right here?

Money Diary: A 32-Year-Old Tech Lead On 68k