This week: “I’m a 26-year-old civil servant living in Brighton. My partner, C, and I moved down to the coast a few months ago after struggling throughout the pandemic and looking for a different pace of life. Having lived together for two and a half years and now working from home, we decided to pack up and head for a comically small, sea view flat. Despite brief periods of loneliness being so far from friends and family, it’s the best thing we could have done and I feel so lucky to have my dream happen. We do have long-term goals of buying a house with a garden and room for a family but have prioritised being close to the city centre so we are renting for now as we continue to save.

I am very anxious when it comes to money, always wondering if I am spending too much, saving too much and not enjoying my 20s like I should, or worrying what would happen if either of our incomes dried up. But I am absolutely an impulse shopper, forever lured by the items in the till queues. Would I like a giant bar of Dairy Milk for just £1? Yes, please!”

Occupation: Project manager

Industry: Civil service

Age: 26

Location: Brighton

Salary: £35k

Paycheque amount: £2,144

Number of housemates: One: my partner, C.

Pronouns: She/her

Monthly Expenses

Housing costs: £637.50 my half of the rent. C is massively underpaid for what he does and earns £25k. I put £200 more into the joint account for food and bills but largely we split everything equally. I pay for petrol and try to get treats where I can to even things up.

Pension? I pay about 4% and my employer tops it up to a decent career average pension.

Loan payments: None.

Savings? £30k in ISAs, £2,800 in short-term savings accounts.

Utilities: £75 my half of council tax, £15.80 water, £48.50 gas and electric, £12.50 internet.

All other monthly payments: £38 phone. £220 yearly parking permit and visitor permits, £260 car insurance. Subscriptions: £8 Netflix, £14 Spotify, £8 Cricut access. £28 Calm app yearly.

Did you participate in any form of higher education? If yes, how did you pay for it?

I hated school and couldn’t wait to get out of there so I didn’t attend university. Instead I have done quite a few professional qualifications and taken evening classes. Some have been self-funded, some my parents paid for and some my employers contributed to.

Growing up, what kind of conversations did you have about money?

We didn’t talk much about money growing up. I was aware that my parents both had tough financial upbringings and they worked hard to ensure me and my siblings weren’t in the same situation. But it was never really spoken about. My mum was much more careful about what we spent and when I was older I could tell that she was worrying about money.

If you have, when did you move out of your parents’/guardians’ house?

I moved out at 23 with my partner, C.

At what age did you become financially responsible for yourself? Does anyone else cover any aspects of your financial life?

I moved into a rented flat at 23 so I would probably say then. However, my parents supported me when I was furloughed for eight months during the pandemic and are supporting me through the next few months with such a sharp increase in the cost of living. So if I’m honest I am not sure I count as financially responsible for myself, although I trust I could be if I needed to.

What was your first job and why did you get it?

Stacking shelves in a shop – I absolutely loved it! I started work at 17 to fund driving lessons and at the time I thought £7 an hour was so much money.

Do you worry about money now?

I never worried about money growing up and I was shielded from any worries my family had. But I worry about money all the time now. I don’t worry so much about the day-to-day spending as I trust we will get by but I worry about the future and whether we’ll ever be able to afford a home, or how we’ll manage if we have to reduce to one income.

Do you or have you ever received passive or inherited income?

No inheritance but instead of supporting me through university, my parents bought my first car, which I loved so much. Since the cost of fuel has increased so dramatically, they have sent me £100 a month to help with coming back to see family and friends regularly. I am incredibly grateful for this. I know I could reduce my savings and manage without but they insisted they wanted to help.

7am: Wake up and make my usual breakfast of yoghurt, granola and berries. Bring C his in bed and we catch up on his shift last night as I was fast asleep when he got home. Nothing eventful.

10.10am: Waitrose delivery arrives. Ironically the one thing we actually needed doesn’t arrive and we’re left with an almost £50 shop we didn’t really need. Put it on the joint account, £23.90 for my share.

12.30pm: C makes lunch to lure me away from my desk. Homemade tomato soup and bread from the shop. Soup is wonderful but Waitrose gluten-free bread is not. Back to Tesco next time. The one benefit of working from home is getting to have lunch together on late shifts. We start to plan our holiday for next year but on finding the cost of renting a car abroad, swiftly abandon our plans.

2pm: Work drags. Skype call a colleague to catch up on events of the week and moan about our bosses. It’s refreshingly cathartic. Oh, how I miss office water cooler moments.

5.30pm: Remember that I ran out of shower gel this morning and place an emergency Boots order to stock up. Add migraine cooling patches to help get me through the winter temperature changes, £19.66.

6.30pm: The static bike I bought on Facebook to save money on the gym stares at me while I catch up on some TV. C wants to get rid as I’ve used it five times in as many months. I briefly consider using it out of spite so I can win the argument to keep it but my motivation fails me.

7.30pm: I cook a chicken and veg tray bake with enough leftovers for C to take to work tomorrow. Eat in front of the TV and have an early night. Evenings on my own are never my favourite.

Total: £43.56

2am: Woken by C arriving home, clattering in the kitchen and blinding me with the torch he uses to get into bed. Immediately fall back asleep with no more than a grunt to C.

7am: Woken by my alarm and consider going for a walk this morning. Decide against it, push my alarm back an hour.

8am: Eventually make my usual breakfast and start the working day.

11am: C has an online briefing for a disaster relief programme he has volunteered for but cannot use Teams for love nor money. After a few minutes of listening to the groans from next door I get it set up and leave him to it. Back to work I go.

12.40pm: C is home, which means another lovely lunch. Today he makes fried paprika potatoes with scrambled eggs. As someone who hates cooking, I really lucked out with C.

1pm: After somewhat reluctantly admitting to bailing on my morning walk, C drags me out for a stroll around the park to enjoy the fresh air. I feel so much better by the time we get home and vow that I definitely will go out tomorrow morning.

7pm: Head out to a netball training session. I was inspired by the Commonwealth Games to try to improve this year so we’ll see if this helps, £7.

8.30pm: I run around much more than usual and regret signing up. Feeling dizzy and a little worse for wear, I am grateful that there are still leftovers from yesterday in the fridge. A quick reheat in the microwave and I collapse on the sofa, food in hand, The Good Place on the TV.

10.10pm: I call it a night and head to bed, hoping I’m not woken quite so abruptly by C tonight.

Total: £7

7am: Despite broken sleep with disturbances from C and the bin collection, I bound out of bed this morning. Make my usual breakfast and head out for a walk on the beach.

12.30pm: I accidentally committed to a very tight work deadline this morning so C makes a quick fluffy eggs on toast and I head back to work.

4.30pm: Working through lunch paid off and I’m finished for the day – make that finished for the week! Turn off my laptop and sit and read with C on the sofa. He’s engrossed in a biography about Napoleon so I decide to continue reading Men Who Hate Women. It’s a fascinating book but I do find it pretty upsetting and only manage a handful of pages at a time.

5.30pm: My Boots order is ready to collect so C and I head out for a walk. I also pick up some dry shampoo and shower gel for C, £5.32.

6pm: Our food is running a little low so we pop into Morrisons for spinach and potatoes to go with tonight’s dinner, and Fantas for the walk home. C pays.

7pm: C has a few days off work and it’s so nice to have company for the evening. He makes steak, chips and mixed greens for dinner. Again, I am eternally grateful for how much C enjoys cooking.

9pm: Back home after heading for a swim with C and feeling exhausted. We plan to watch some TV in bed but I fall asleep immediately.

Total: £5.32

9am: We have a slow start this morning, enjoying the rarity that our weekends collide. C makes breakfast in bed.

10.40am: There’s a makers’ market at the city’s open market so we pop down to see what it’s like. C buys some veggie sausage rolls, local honey and mead for his parents and a lemonade for us both. I find a gluten-free stall and buy two doughnuts and a chocolate fudge bar, £8.

11.50am: Neither of us can face the steep hill on the walk home but I persuade C that an Uber is wholly unnecessary and instead we get the bus. I pay for us both, £4.60.

1.30pm: After a quick lunch of cheese toasties and all the baked goods we’ve just bought we jump in the car and head to my parents’. We have a few plans with friends this weekend and plan to use my parents’ house as a base.

3.50pm: Arrive at my parents’ and sit in their newly landscaped garden. It looks beautiful and it’s lovely to have a proper catch-up.

5.30pm: Pack up the beers and food we bought earlier in the week and head to a gathering hosted by some of my friends from school. While the girls catch up, the partners sit and chat football for two hours. I can see C desperately wants to change the subject but after multiple attempts proves unsuccessful. Thankfully it’s time to start cooking, which frees him from the men’s table.

11.30pm: We all call it a night and head home. This is the time when I’m the most grateful for being sober as I can just head home without spending on a taxi.

Total: £12.60

8.30am: C is feeling a little worse for wear so I make myself breakfast and sit and eat with my mum. She has just finished her last day at work before moving to a new job and I couldn’t be happier for her.

10.30am: C finally manages to get out of bed and get dressed. We have separate days planned today but only one car so I drop him over at his parents’ for the morning. He’s in the process of selling his car, which has been sitting on his parents’ drive since we moved. He gives it a clean and clears out all the mess so we can organise a sale without having to go back.

11.30am: I’m going for brunch with my best friend, A. She is in such a good place at the moment and radiates joy. It makes me so happy to see her like this. We set the world to rights over a full English and a lemonade, £13.10.

1pm: There is a new dessert place open in the town centre and A has a voucher. She gets herself a strawberry cheesecake and honeycomb, and treats me to a sorbet pot. Both are delicious.

2.30pm: I head back to my parents’ to catch up with my dad. I missed him this morning while he was out on a 13 mile run. I think he’s mad but he loves it!

3.30pm: C has been out for lunch with his schoolfriends and I plan to join them for a drink after but as I get in the car I get a call from C that a few of them have got too drunk so I pick him up and we drive back over to his parents’. It’s been a while since I’ve seen them so it’s nice to catch up.

6.50pm: We finally make it home after a drive with many stops as I feel really travel sick. I collapse on the sofa while C makes dinner.

8.30pm: Still feeling really rough so I head to bed. C finishes up some tidying and joins me. He reads while I fall asleep next to him.

Total: £13.10

5am: C leaves for work. I wake up for all of 30 seconds to say goodbye and nod off straightaway.

7am: Wake up feeling much better and vow to drink more water today. There are builders working on scaffolding next door directly outside our bedroom window and we forgot to shut the curtains last night. Spend 20 minutes deliberating how to get up without flashing them.

7.30am: Decide it’s not possible so keep my head down and make a run for it, grabbing a dressing gown on the way. Make my usual breakfast and spend the next hour before work sorting washing and tidying the flat instead of going for a walk.

1pm: We are almost entirely out of food so I have a very tragic lunch of two hard-boiled eggs and the last noggy end of bread. I place a Tesco shop to arrive tomorrow but I may well need to go out for more bread tonight. £87.28 on the joint account, £43.64 for my share. We spend much more than I think we should on our weekly shop but gluten-free food is so expensive and it has to cover three meals a day for seven days, plus lots of snacks.

6.20pm: Netball time aka my favourite part of the week. It would be cheaper to get a gym membership than pay this three times a week but I really enjoy team sports. Transfer £5 to team captain. Agree to stay on to help the next team out as they are a player short, another £5. Also spend £2.90 on parking.

8.30pm: As I crash on the sofa in a sweaty mess, C cooks us veggie spag bol from the freezer. We batch cooked a few weeks ago and are both grateful for this now.

9pm: We fall down a YouTube rabbit hole about matched betting and decide it’s worth giving a go. With the increase in the cost of living we need to find a way to supplement our incomes somehow and I find the concept really interesting. I deposit £65 in various accounts. Now it’s a waiting game.

Total: £121.54

7am: My usual breakfast is off the table due to lack of food so I have frozen berries in the dregs of a large yoghurt pot. Yum. I should really pop to Co-op as lunch is looking even more dire but it is pouring with rain and I can hear thunder crashing in the distance so I decide it’s not worth it.

8am: I see there is an offer on 26-30 railcards and think it’s worth doing as C and I have a couple of London trips coming up and anything to help reduce the cost is appreciated, £20.

1pm: I cannot stand another day of lunch with no food in and briefly consider Deliverooing a Leon. As we also need washing up liquid and some veg for tonight I walk down to Morrisons instead. Somehow veg, cheese, bread, crisps and dessert comes to £19.22. I put it on the joint account, my half is £9.61.

7pm: It’s mixed netball tonight. I go every week and C joins me when he’s not working. We both go tonight and it’s a real treat. I’ve managed to put one of my contacts in the wrong way round and everything is a little blurry. It makes shooting difficult so I stick to defence today. C pays.

8.30pm: The Tesco food delivery arrives early and I feel much calmer now we have a stocked fridge. We had already started cooking dinner so it’s an odd one: half of a frozen pizza, chips, spinach, leek and peas. Doesn’t stop us devouring it in minutes though!

Total: £29.61

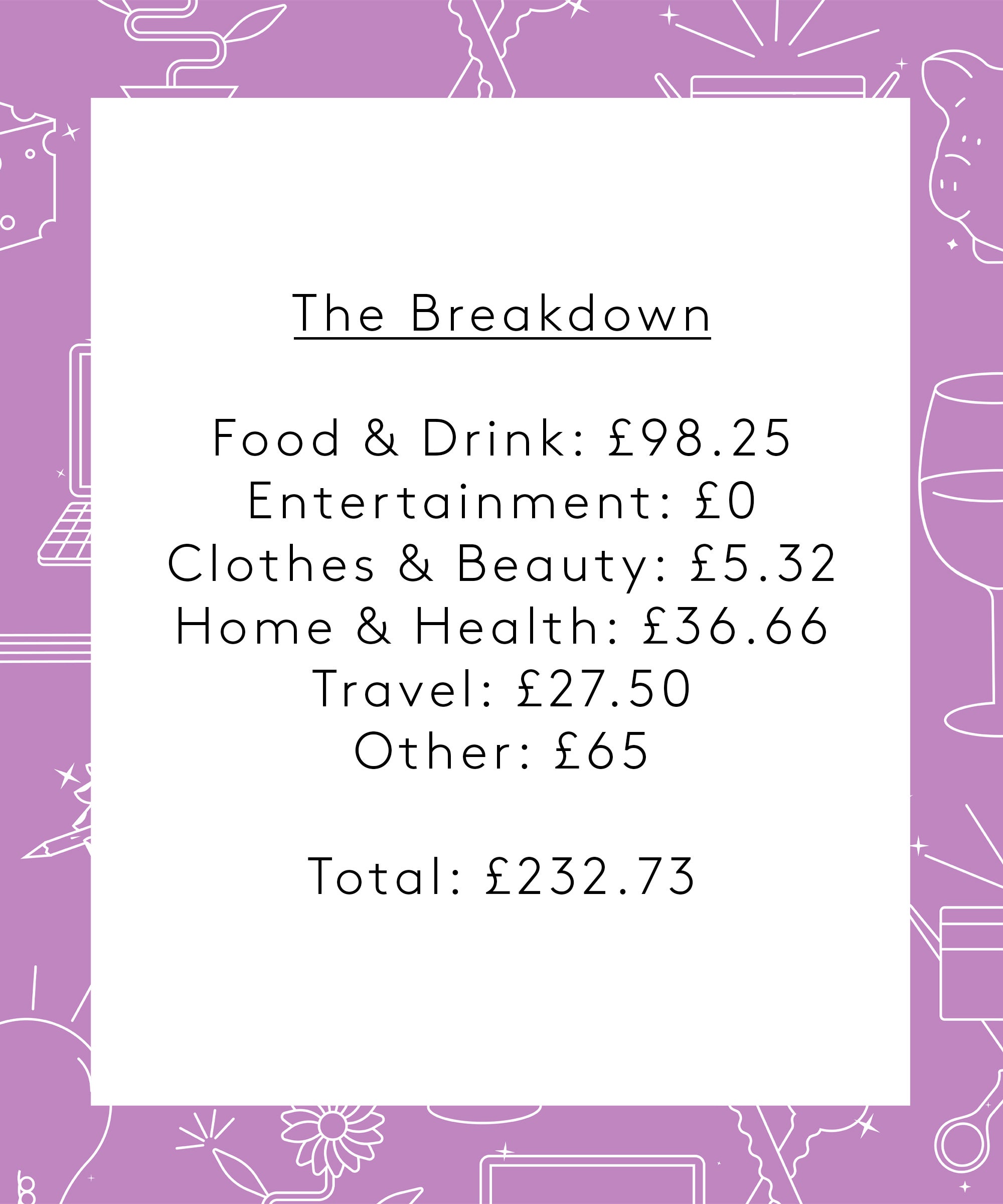

Food & Drink: £98.25

Entertainment: £0

Clothes & Beauty: £5.32

Home & Health: £36.66

Travel: £27.50

Other: £65

Total: £232.73

Conclusion

“I think I spent less than usual this week, partly because tracking and writing down my spending curbed my impulse buying but also because ‘entertainment’ spending is pretty low for us. Usually every couple of weeks we’ll either go out on a date night or buy tickets for a future event or activity we’d like to do. I certainly would like to continue to keep track of my spending to see if there are any other areas where I could spend less.”

Like what you see? How about some more R29 goodness, right here?

Money Diary: A Junior Doctor In Manchester On 34k