This week: “I’m a 27-year-old first time mum on maternity leave from my job in childcare receiving statutory maternity pay. I have an undergraduate and postgraduate degree and always wanted to be a family support worker, but worked part-time in childcare throughout my degree and carried on afterwards. I worked my way up to become a room leader and third in charge of the nursery. In two months’ time, I’ll marry my fiancé. We have a four month old little boy so life is very full right now.”

Occupation: Room Leader

Industry: Childcare

Age: 27

Location: Warwickshire

Salary: I am currently on £156.66 p/w statutory maternity pay (previously £11.20 p/h before maternity). My partner and I now merge finances and his salary is £21,000.

Paycheque Amount: Currently around £650 per month and my partner’s paycheque is £382.75 p/w. We also receive child benefit which is £87.20 per month (previously it was roughly £1,700 per month after tax, NI and pension).

Number of housemates: Two. My fiancé D and four month old son, R.

Pronouns: She/her

Monthly Expenses

Housing costs: £450 rent for a three bed house.

Loan payments: I don’t reach the threshold to pay my undergraduate loan yet, but my postgraduate loan is around £7 (depending on earnings).

Savings?: £750. We transfer a family member £150 per week for savings, but costs for our upcoming wedding has impacted this.

Pension?: I pay into it each month, but can’t remember the percentage I pay or what my employer pays in!

Utilities: £181 gas and electric, £117 council tax, £75.71 per year for water (we only pay for drainage).

All other monthly payments: £70.41 for my phone (ridiculously high), £10 sim only, £13.25 TV licence, £15.75 car tax, £33.69 broadband. Subscriptions: £6.99 Playstation Network, £10.99 Netflix, £7.99 Disney +, £10.60 National Trust Membership, £0.79 iCloud storage (too many cute baby pictures).

Did you participate in any form of higher education? If yes, how did you pay for it?

I studied for an undergraduate degree in Working with Children, Young People and Families and a Master’s Degree in Youth and Community Work. I received the maximum student finance loan due to coming from a single parent household so my rent and fees were covered by this. I also had part-time jobs throughout university in retail and bar work to cover living expenses.

Growing up, what kind of conversations did you have about money?

I don’t ever remember us having conversations about money growing up. I felt lucky as a child as we’d go on holidays every year, days out and had all the latest gadgets etc. It wasn’t until I was older that I realised that we struggled financially, particularly when my parents split up.

If you have, when did you move out of your parents/guardians house?

I moved out of my mum’s house at 18 to live at university. During the holidays I would stay at either of my parents’ houses or my sister’s. I moved in with my dad when I was 23 after a relationship breakdown but only stayed there a few months before I moved into a house share.

At what age did you become financially responsible for yourself? Does anyone else cover any aspects of your financial life?

I wouldn’t say I am financially responsible for myself. If it wasn’t for my partner I wouldn’t have any income left after paying my half of the bills on maternity leave. I know both of my parents would help out when needed but I don’t like asking and hate accepting when they do offer. After getting to a good stage financially after struggling with debt it’s hit me hard that I now have to rely on my partner for help being on maternity leave.

What was your first job and why did you get it?

My first job was a paper round at 14. I got it for some independence and to earn my own money and I have worked either part or full time ever since.

Do you worry about money now?

Definitely. I managed to get myself out of debt two years ago after leaving a controlling relationship where I believe my partner racked up debt in my name by regularly take out payday loans to pay the bills. I now have a rubbish credit score which affects more than you think and the thought of getting back into debt is always in the back of my mind. Since being on maternity leave I worry more about money as I’ve lost over a £1,000 a month of income and having a baby isn’t cheap. We saved throughout my pregnancy for the big expenses and now live more frugally than we did. I’m a massive spender (after being in debt I have the mindset of ‘treat yourself’) and my partner is more a saver so we clash quite often about this.

Do you or have you ever received passive or inherited income?

On my 18th birthday I received money from my dad that he had been putting into a savings account since I was a baby, I can’t remember the exact amount but think it was around £1500. My great uncle died when I was 22 and we were very close, so he left me £2,500 in his will which I paid for an intense driving course with and the rest got wasted (see controlling ex above). I’m not sure if this counts but I was also awarded £7,500 in an employment tribunal when I was 17 which was used for a big holiday to Thailand and alcohol when I went to university. Looking back I wish I would have done a lot more with the money but my parents didn’t teach me anything about finances so I was pretty clueless. My dad is also paying £8,000 towards my wedding and my mum around £3,000.

We’re working on something exciting and would love your help! We’re looking for women aged 25-40 who have an American Express Platinum Card to take part in a paid opportunity around R29’s Money Diaries. Please email moneydiary@refinery29.uk with a bit about you, your age, location, salary, occupation, and the Platinum Card benefits you use the most.

7.45am: Up with R who had a terrible night. Breastfeeding is great until that’s all they want/need to help them to get back to sleep eight times a night.

10am: Get the pushchair and walk to our local children’s centre for a baby massage group. I go via the Amazon Hub lockers to collect an open top cup I ordered for R as he refuses a bottle.

11am: Finish the massaging lesson. Today is the final session and I’m feeling a little sad. I relocated to Warwickshire three years ago but carried on working in the West Midlands so I don’t know anyone in our area apart from my mum. I pushed myself out of my comfort zone to take R to classes to get us both out the house and meet people, so it is sad it’s ending.

11.45am: Get home and put R down for a nap. I start on my flexible working request form for when I return to work in May. I’m hoping to go term time only but I don’t hold out much hope. Eat a nutritious breakfast of hula hoops.

1.15pm: R wakes up. I love baby massage as it’s his best nap of the week! I feed and change him then play on his mat for a while. This week he’s started sitting unaided so I spend some time practising this new skill!

3.20pm: Nap time! I have a more nutritious lunch of Aldi super noodles and pay a deposit for a trial for my wedding day makeup, £15. We get married in nine weeks’ time so I’m sorting out and arranging the last bits needed.

3.45pm: Nap time didn’t last long. Feed and change, play and read books for a while.

4.30pm: Daddy’s home! Pass baby over and head for a bath. I prioritise having a bath every day when D gets home from work as I never had any time until about a month ago.

5.10pm: Out the bath and it’s a mad dash trying to find the log book for my car as someone is coming to buy it later. Thankfully, find the log book after searching every drawer in the house!

6pm: Buyer comes for the car, get £500 bank transferred.

6.01pm: Transfer the £500 to my mum. Our new car is £1,500 and she’s lending us the additional £1,000 needed. It is an expense we could do without but a bigger car was needed.

6.20pm: R goes down for a nap, danger nap territory but he needs a quick one.

6.30pm: Decide it’s too late to cook so order an Indian instead, £21.60. We hardly ever have takeaways anymore so it’s a Friday night treat!

6.40pm: R is awake, so feed and change. D goes for a bath so I stick Ugly Betty on and play with R.

7.22pm: Dinner arrives and miraculously manage to eat a hot meal at the same time as D. Winning!

8pm: D gets R ready for bed then I go in to feed him to sleep.

8.32pm: R immediately wakes up, D goes to settle him. R won’t settle so boob to the rescue.

8.50pm: R finally down so we go to bed to watch Friends and hopefully get a few hours sleep before R wakes up again.

9.20pm: Hopes dashed, R back awake – think we’re in for a long night. R settles after a couple of minutes. Sleep.

Total: £36.60

7.40am: Wake up naturally after a night up and down with R. Drink coffee and wait for R to wake up.

8.45am: R wakes up and I’m annoyed I didn’t take advantage of a lie in. Change R and bring him to bed for a feed and cuddles.

10.45am: R down for his first nap. No one prepares you for the vicious cycle that is nap time before you’re a parent. I spend my time watching TikTok instead of doing something productive.

11.25am: R is up, usual routine: nappy change, feed and play. Eat a more nutritious breakfast of a yoghurt today.

12.30pm: Manage to shower, brush hair/teeth and put moisturiser on whilst R entertains himself on his play mat in the bathroom. This is a luxury these days and I’m feeling nice and fresh.

1.45pm: Do some wedding admin whilst R has a nap.

2.30pm: Mum pops round to take us to get our new car, we’ve bought it off her partner who’s a mechanic.

3pm: Get to mum’s house and sort all the car details out such as updating tax, changing ownership of car etc.

4.30pm: Go to pick D up from work. R has fallen asleep in the car so we go for a drive to get used to the new car. We end up at the Starbucks drive-thru and both have a frappe, £8.78.

5.45pm: Get home and start cooking dinner. We were supposed to go food shopping tonight but it’s too late now after R’s nap. So, we make a quick dinner of mushroom and pepper stir fry with veg spring rolls.

7pm: Go for a soak in the bath. R joins me in the bath after about 30 minutes. I love our baths together and he’s happily splashing away.

7.50pm: Out the bath and D gets R ready for bed, then I go in to feed him to sleep.

8.20pm: D and I head to bed. We watch 17 Again whilst eating cookies and drinking decaf tea. Oh how Saturday nights change after having a baby!

10.05pm: Fall asleep during the film. Wake up to the credits playing and a hungry R.

Total: £8.78

3.58am: Feed R. Best stretch of sleep in a while!

7am: Alarm goes off, promptly fall back to sleep.

7.50am: Shit. Woken up by R. We’re supposed to be leaving the house in 10 minutes to drive to Birmingham to meet friends for coffee. Quickly feed R and get ready.

8.20am: Leave the house only 20 minutes late, small win.

9.15am: Meet friends at Starbucks with R after dropping D at my dad’s house. When we come back to Birmingham we try and see all family members in one trip so we will see his family later. Order a decaf iced caramel macchiato and a toastie, £9.80.

10.20am: Go to dad’s house for a cup of tea and to pick up D. I leave 30 minutes later to go see D’s family.

11.15am: Arrive at D’s dad’s and spend time with him, his siblings and niece. D’s sister has got R the cutest Stitch [Lilo & Stitch] coat (we are a Disney household). D’s niece tries on her flower girl dress and tells us she feels like a princess.

2pm: Leave D’s family and head home. We decide to go to a woodland park by us since it’s a nice day, £3 for parking.

2.45pm: 10 minutes into the walk R leaks through his nappy all over himself and D. Head back to the car.

3pm: Get home, change and feed R.

3.20pm: Head to the local Asda to get something for dinner tonight. We’ll do the weekly food shop tomorrow.

3.45pm: Pick up bits for dinner, tip tops (a craving that started during pregnancy and strangely continued), some sleep suits for R and a few little bits, £17.90.

4.15pm: Bath time while R plays and D entertains him while playing Fifa.

5pm: R has fallen asleep on D. I start dinner of steak pies, potatoes and more veg. Pop on The Hobbit whilst R sleeps. Sunday is always a film series day and since we finished Harry Potter last week it is time for The Hobbit to begin.

5.45pm: R wakes up grumpy so has a feed and falls back to sleep.

6.15pm: R wakes up as soon as dinner is ready (swear he smells it and just likes me to eat cold dinners). Try laying him next to us and playing but swiftly give up as he’s too grumpy and cuddle him until D has finished eating then eat mine.

6.45pm: Take R to his room to play for a while to unwind before bed. Sing, read stories and play for the next hour.

7.45pm: D gets R ready for bed. He’s teething really badly so pop some cream on which R immediately tries to lick off.

9pm: Into bed after getting R down. Finish watching The Hobbit. One day we might watch a film all the way through instead of in three parts…

9.10pm: R is up and won’t go back down so comes into our bed for cuddles and another half hour feed.

9.45pm: R back down (hopefully for a few hours), stick Friends on and go to sleep.

Total: £30.70

2.56am: Feed R.

5.03am: Feed R.

7.38am: After a night up and down with R, he’s up for the day. D changes the nappy then puts him in bed with me for cuddles.

7.50am: D makes coffee then goes to work.

8.10am: After 23 attempts to get through to the GP, I manage to get an appointment for R at 11.40am.

9.30am: My mum comes round. We spend every Monday with her as she doesn’t work today and she’ll be looking after R on a Monday for me when I’m back at work.

11.20am: Walk to see the GP. R has eczema so I’m given some cream for him that we collect from the pharmacy. Decide to walk into town as it’s a nice day.

12.40pm: Get into town and head to Weatherspoons as R is asleep for lunch. Of course he wakes up as soon as we order! Burrito bowl for me (10/10 recommend) and chicken basket for mum, which she pays for. Whip my boob out after eating to feed R.

1.20pm: Have a mooch around town and get birthday cards for my stepsister, shampoo, and vapes, £26.57. I was a 20-a-day kinda girl until I got pregnant, so I’ve moved onto vapes and these will last me about a week.

2pm: Have a look in Next and mum gets R two new outfits.

2.30pm: Start the walk home and R is having none of being in his pushchair. He’s so tired but is fighting hard so we take it in turns carrying him home which is FUN. Grab D a bottle of Lucozade, cookies and an Easter plate for R from the shop on the way home,£4.25.

3.45pm: Get home and mum leaves. Try and settle R and he has a 10-minute nap.

4.40pm: D is home so we head to Aldi for food shopping. Get meals for the week plus some snacks, nappies and wipes for R, £50.26. We normally spend about £30 more than this so I’m feeling pretty smug.

6pm: Shopping away, time for this mum to have a bath.

6.50pm: Put dinner in the oven: chicken and patatas bravas. R wakes up and we attempt to watch the last of The Hobbit from yesterday.

8.20pm: Usual night time routine for R.

9.30pm: R down, into bed to watch Friends and fall asleep.

Total: £81.08

7.42am: R up for the day after feeding throughout the night. Usual morning routine begins.

10.10am: Pick up my niece and nephew as they’re staying for a few nights.

11am: Bring them to the hairdressers so my niece E and I can get our hair done. Not the most relaxing time with kids aged 16, 10 and four months old. R doesn’t sleep the whole time we’re there so is miserable and clingy.

3pm: Hair done, £63. I’m not happy with it as she bleached my hair without telling me but end result isn’t too bad.

3.40pm: Get everyone home and E and F are starving so we order some McDonald’s, £13.98. I try and finally get R for a nap but he’s having none of it.

4.30pm: D arrives home from work and instantly asks me what the hell I’ve done to my hair. He takes pictures of the back and my hair is all damaged from the bleach with lots of patches where the dye hasn’t taken on top of the bleach. Instantly cry as my hair looks ruined and it’s only two months until the wedding.

5pm: Go to mum’s house to collect R’s new car seat. Show mum hair and she says I have to complain (I hate complaining).

5.30pm: Message hairdresser addressing concerns. I receive an apology and acknowledgement that she knows she messed my hair up. The refund is now pending and they offer to fix my hair free of charge.

6.30pm: Start cooking spaghetti bolognese for dinner. E and F are very fussy eaters and this is the one meal they’ll both eat so it gets cooked a lot when they come to visit.

7.45pm: Usual night time routine for R.

8.45pm: Make pancakes for E and F that go completely wrong so they begrudgingly eat ready made ones.

9.30pm: Bed time.

Total: £76.98

6.22am: R wakes up after 10 minutes of being put back down, so he comes into our bed for cuddles.

7.10am: R asleep again, back in his bed. D makes coffee and gets ready for work. Chill in bed until R wakes up again.

8.10am: Usual routine after R wakes up. Make breakfast for F. E is 16 and stays in her pit until lunchtime.

12.30pm: Finally everyone is up. We go the woodland park that we went to the other day and don’t pay for parking this time.

2pm: Cobwebs have been blown. I even managed to convince E and F to play together in the park whilst R napped.

2.15pm: Home and make lunch. Toast for F, pasta for me and E.

4.30pm: D is home. We go to the shop with E to get some treats for film night consisting of popcorn, chocolate and sweets, £9.94.

5pm: Head for a long soak in the bath, debate why I want multiple children.

6pm: Start dinner of sausage, mash and veg for me, D and F. E wants Super Noodles and garlic bread.

7pm: Film night begins with the best of the best Grease and snacks are opened.

7.50pm: Usual bed time routine with R. I miss the last half hour of the film (story of my life) and Transformers is on when I come downstairs.

10pm: Head to bed. Watch Friends and sleep.

Total: £9.94

7.09am: R up for the day after night feeds, usual morning routine.

8am: Wake up the grumpy teenager that is E and greeted with a happy smile (I wish). She does get out of bed and get ready though.

8.45am: Leave the house to drive to Birmingham.

9.30am: Drop F at my dad’s house then go to a friend’s place with E and R to get our nails done.

12.30pm: £15 for nails. Sparkly blue for me, red and black for E.

1.20pm: Meet dad for dinner at his local pub. I have mac and cheese topped chips. This is dad’s treat for bringing the kids over to him (he has epilepsy so lost his licence about 10 years ago).

2.45pm: Me and R leave to drive to my sister’s, put £20 petrol in on the way.

3.50pm: Leave R with my sister (for the first time) and go to hairdressers to try and fix my hair.

6pm: Hair looks so much healthier and better! Go and pick R up.

6.15pm: R was getting grouchy with auntie so I give him a feed and he’s all smiles again.

7pm: Get home and D hasn’t started dinner, typical! Shove some chicken goujons in the oven to have in wraps.

7.40pm: Usual bed time routine for R.

8.30pm: Get into bed to watch a film. D has booked tomorrow off work so I’m looking forward to having help with R.

9.20pm: Fun time with D using a condom as we don’t want anymore babies for a while but birth control really messes me up. Laugh about using condoms even though we get married in two months.

10pm: Watch Friends and then sleep.

Total: £35

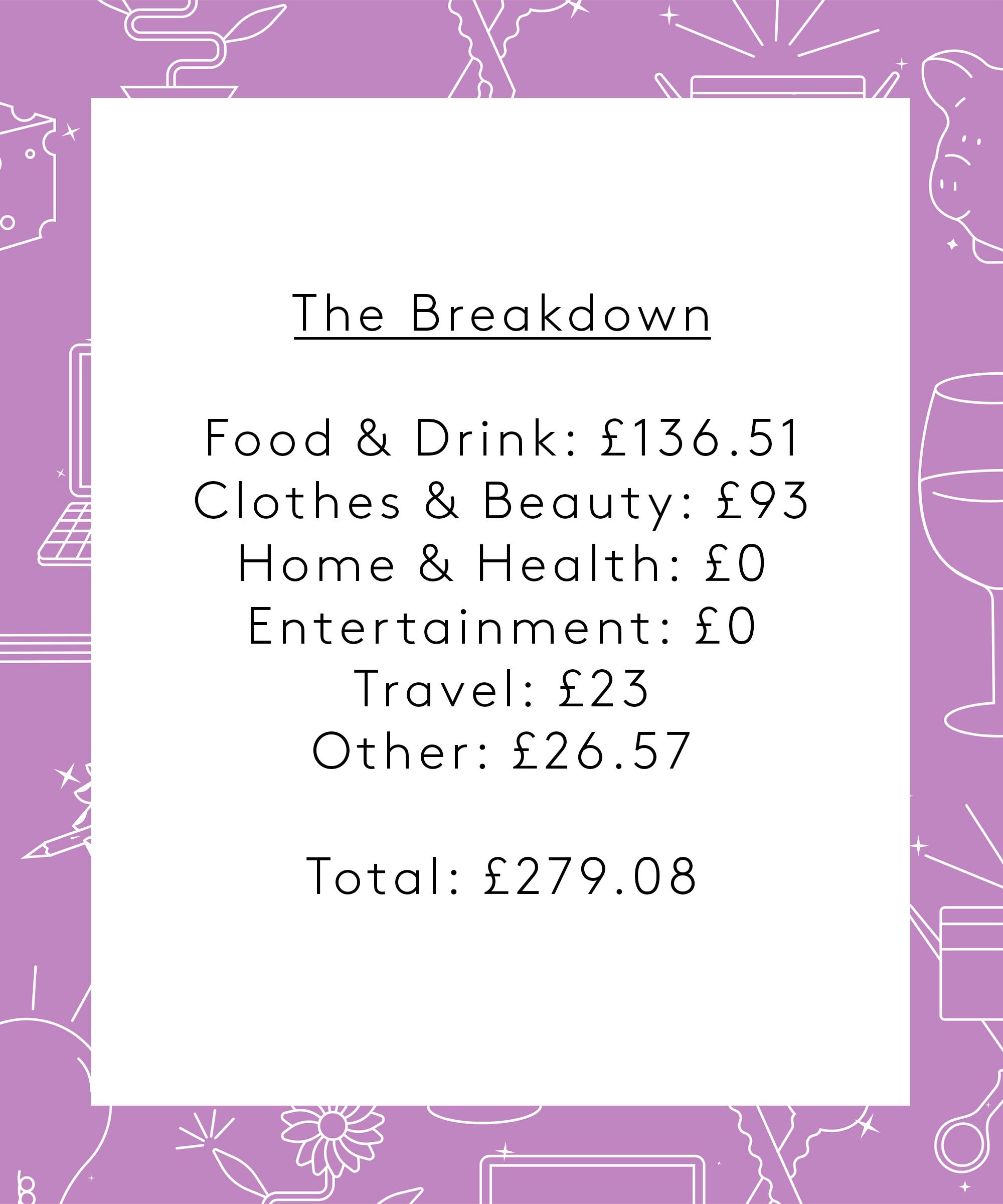

Total: £279.08

Food & Drink: £136.51

Clothes & Beauty: £93

Home & Health: £0

Entertainment: £0

Travel: £23

Other: £26.57

Conclusion

“This wasn’t a typical week for me due to getting my hair and nails done, and booking the make-up trial. I normally have a few no spend days throughout the week because me and R don’t leave the house, but due to having E and F we went out every day and the cost adds up. All the little food and drink purchases add up as well which I didn’t notice when doing it here and there. I definitely need to stop picking up little treats with money being tighter from paying the car off!”

Like what you see? How about some more R29 goodness, right here?

Money Diary: A Charity Programme Manager On 36k