This week: “I’m 25, live in Kent and currently work two jobs, one in a wine shop and the other as a door supervisor. I’ve been doing both jobs during COVID-19, and usually put the money I earn from door supervising (which has turned into security guarding at a supermarket during COVID – where do all these people come from?!) into my savings.

I’m currently having a quarter life crisis and deliberating whether to do a PGCE to become a history teacher. I live with my now ex-partner (I had a Phillip Schofield moment where I basically realised that I’m gay, but we still had the tenancy agreement on the flat for a good six months and no break clause) and my cat. I will be moving back in with my parents in August as finding a flatmate at this time has been challenging.”

Occupation: Sales assistant and door supervisor

Industry: Retail

Age: 25

Location: Kent

Salary: £17,750 from my day job.

Paycheque amount: £1,325 a month from my day job. Security shifts at the moment are minimum wage so £8.72 an hour, usually eight-hour shifts, which ends up at around £68 a week if I just do a Monday shift.

Number of housemates: One (my ex).

Monthly Expenses

Housing costs: £350 on rent, gas and electric, £40 on water, £80 on council tax and £15.99 on Wi-Fi (this is all my half, I wish I could get a flat for that price).

Debt: None.

Savings? I tend to put between £100 and £150 in my savings each month from my main pay packet, and then whatever I earn from security work.

All other monthly expenses: Phone bill £48. Spotify £9.99 (might cancel this for Amazon Music). Amazon Prime £3.99. Car insurance £51. Razor subscription £4.99. Contents insurance £4.50. Car loan (I pay my mum monthly for her old car as she had a midlife crisis and bought a Jag, and I needed a new car as I was doing a lot more mileage at the time).

5.30am: I don’t start work ’til 10am on a Saturday and am meant to be going to the stables at 8am with my mother to look at the horse I rode yesterday and Thursday. The horse has had six months off in a field and has only just come back into work. I’ve not owned a horse since 2014 and not ridden in over two years. I wake up to wee, let the dogs out and then go back to bed.

7.30am: Get up to my alarm. Mother gives her excuses for not coming to watch me ride.

8am: Drive the 10 minutes to the stables. It’s so nice being around horses again. Ride again and she is perfect.

9am: Leave the stables, head to my flat and jump in the shower and get ready for work. Thank god I don’t wear makeup to work.

10am: Start work and have quite a few good sales.

2pm: My boss comes in and shouts at me along the lines of, “This isn’t a democracy, it’s a dictatorship.” I spend a good amount of time crying because I feel incompetent and as though I have been mis-sold a job where I was meant to be manager, yet I am micromanaged. I don’t have a contract and apparently am not allowed a break apart from on my 11-hour shift on a Tuesday. Who needs food or employment rights?!

5pm: Leave work pronto and go home. Made the plan to run. I’ve run two half marathons, multiple 10ks, several 10-mile races, 51 parkruns and a few 5k races in my time but at the moment I really struggle to run even once a week. I sit down with the cat and open a bottle of Chapel Down Bacchus that I bought a few weeks ago because it was 25% off in Waitrose (could this statement be more lesbian and middle class at the same time?) and watch both episodes of RuPaul’s Drag Race All Stars. I am totally here for Jujubee, Alexis Mateo, Shea Coulee and Blair St. Clair. I feel like Shea will win though as she’s just so polished.

7.30pm: Eat some Quorn southern fried bites, curly fries and a quarter of a Morrisons vegetable quarter pounder. I am not a fan and end up leaving most of it. Realise that everything seems to give me indigestion these days.

8pm: Pour a Warner’s elderflower gin and slimline tonic and head to bed. Scroll through WhatsApp and social media for far too long.

Total: £0

Early hours: Wake up sporadically needing a wee, can’t tell you what time it is. Get up and pee, eat some chocolate chips and fall back asleep.

10.30am: Wake up again, read some of Runner’s World like I actually run (LOL) and again fall back asleep. I don’t even feel guilty as it’s my one day off.

2pm: Have an oat milk iced coffee with vanilla syrup and some smoked salmon quiche. Health. I then laze around in bed with the cat, put some laundry on and sort out the floordrobe.

3.30pm: Shower and get dressed to go ride. I pump up the tyres on my car. I have my own tyre inflator as I have a slow puncture and I don’t want to pay for new tyres just yet. In my old job I used to do over 500 miles a week so it would have been imperative to get them done, but at the moment it seems like wasted money.

4.15pm: Watch J (my friend) ride her horse. My auntie who is not my auntie has an Arab mare that I can ride until she’s sold so I head out into the field and catch her. The only issue with that is that I quite like this horse myself… Horse apparently doesn’t like being caught but at least she looks pretty trotting around. Finally catch and school her. She feels so different from three days ago already.

6pm: Get home, hang the laundry on the clothes horse. Make a Quorn chicken, mushroom and spinach cheesy tomato pasta. I stopped eating meat in summer 2017 as I really went off the taste, it was expensive and I realised that if I love animals so much then I probably shouldn’t eat them.

7.30pm: Watch A House Through Time on BBC iPlayer on my laptop in bed. End up falling asleep about midway through. It’s the second episode and is about 10 Guinea Street in Bristol. It’s really interesting given the house’s link to the slave trade and everything that’s going on with Black Lives Matter.

1.30am: I’ve been falling in and out of sleep and realise it’s 1.30am on a Monday morning. I’m wide awake and my alarm goes off at 4.40am on a Monday! However I did have a no-spend weekend and I can’t remember when that last happened, so swings and roundabouts.

Total: £0

4.40am: Alarm goes off and I throw myself straight up, dressed and out of the door for 5.20am to drive the 30 minutes to the supermarket that I’m guarding today. Drink a can of Pepsi Max, eat some Tyrrells veg crisps and have a cereal bar while driving and listening to Radio One play some absolute throwbacks. Magic.

5.50am: Clock in for my supermarket shift on my phone both via the app and the number I have to call as I’m a subcontractor that’s subcontracting under a different company.

10.30am: Break time! I try to place my

break halfway through my shift so it feels nicely balanced. Spend £1.50 on a Monster Mango Loco because caffeine. Then I go into the staff canteen and get two slices of toast, two fried eggs, two hash browns and beans for a grand total of £1.40. Gotta love staff canteen prices.

12.45pm: Pop into the shop next door and buy three packs of pear drops (cannot find these anywhere apart from this newsagent) and a drink as there was a minimum card spend of £2. Comes to £4 after Monzo round-up.

2pm: Shift ends and was eventful. This morning I had a regular who sees me every Monday and tries to give me his number while I politely decline saying, “Thanks but no thanks because I’m gay.” His colleagues who he comes in with find it hilarious. In the afternoon I had to deal with an incident where some youths smashed a window and leg. CCTV doesn’t cover that area of the store. Fab. Half an hour after that I had to intervene in an argument that a colleague was having with a man queuing. He threatened to stab him with a nail gun(!) and then called me an awful word which I told him was homophobia and a hate crime. I logged it on the security system and filmed it on the bodycam, but not sure I have the energy or the effort to report it to the police.

2.30pm: I do a quick food shop for myself and Mum. Pick up three lots of cheese and onion-topped rolls, a tiger loaf, cheddar cheese, two packs of rocket, a toothbrush, two packs of dried mango (so good and such a good alternative to sweets), shaving foam, Babybels, 24-pack of Diet Pepsi and some carrots for the horses. Comes to £24.65 but Monzo rounds it up to the nearest pound so £25.

2.45pm: Fill up the car at the petrol station as I’ve only got a quarter of a tank left and diesel is still only £1.04 a litre! Fill it to the top and it comes to £36 after the Monzo round-up. I used to have a petrol car before I had a job with a long commute. I’m paying my mum back monthly for her old car as she had a mid-life crisis and bought a Jaguar. With my old job and old car I would have had to fill up twice as much. Now I do hardly any miles so a tank of petrol can last a month.

3.30pm: Quick turnaround of getting changed, grabbing some stuff and going to the stables. Ride again and then help J finish off her horses as her mum (my auntie that’s not my auntie) gets the call to go be a kitty midwife, as she breeds cats and dogs for a living. Drop J home as it’s on the way to my mum’s.

6.45pm: Drop into Tesco to get some ice for my mum as it would have melted in the boot if I’d got it from work. £2 after round-up (80p of that straight into the savings pot – ka-ching!).

7pm: Arrive at my mum and stepfather’s and they pour me a large Limehouse pink gin and tonic. Love Limehouse gin, it’s very underrated. I prefer their aromatic gin but this does well for a pink gin. I go into the shed and pull out the boxes with my old horse stuff in and try to find stuff to make up a bridle for the horse I am riding. I manage to find a bridle, a head collar, two sets of stirrup irons, two sets of stirrup leathers, a bit, some bandages and some other stuff. Manage to get the mould off with hot water, saddle soap dregs and olive oil to soften it up.

7.40pm: Mum feeds me and I have a Plant Kitchen southern fried fillet in one of the cheese-topped rolls I bought earlier with Dairylea cheese slice and salad. So, so good.

10pm: Watch TV and fall asleep in bed with my mum’s two dogs.

Total: £69.90

6.30am: Alarm goes off as I had the intention to run before work but who am I kidding? Reset it for 8.30am.

8.30am: At some point in the last two hours the other two dogs have joined me, so that’s now a human and four dogs in bed. They’re not impressed with me getting up to shower as they know it means I’ll be going to work.

8.45am: Monzo notification to tell me that £16.50 has been taken from PayPal for a present for my friend’s new baby (I’m basically the fun drunk auntie) from John Lewis. It was a soft toy. She sent me a picture and it’s so sweet.

9am: Leave Mum’s and drive the five minutes to Tesco to stock up on supplies for the long day at work. End up with a meal deal (Monster White Ultra, Plant Kitchen falafel wrap and a Mars duo), a Purdey’s Rejuvenate, pains au chocolat, cereal bars, Oreos and chewing gum. Comes to £9 after the round-up. Drive the 20 minutes home to collect keys and my apron.

9.55am: Arrive at work. Tuesdays are my long day at the wine shop. I work open to close, which is an 11-hour shift. It’s hard but I’d rather do that than have to work six days a week. I’m contracted to 37.5 hours a week and this suits me better. I used to do 13.5 hours a day in my old job with a 90-minute commute either side so this is easy in comparison.

2pm: Transfer £500 out of my Monzo savings pot to my mother. I’ve decided to buy the horse. This sounds really wild and extravagant; I was not planning on buying a horse but when she turned up to my auntie’s last week and she said I could ride her until she’s sold…things changed. I missed riding and I hadn’t ridden in over two years since selling my old horse when I went into my second year at uni. I didn’t expect to fit this new horse so well and after a lot of persuasion I’ve managed to borrow £1,000 from my mother to buy her, much to my stepdad’s disapproval. The plan will either be to work on her to sell and I’ll give my mum the money back when she’s sold, or I will keep her and pay her back in instalments.

5pm: Break time! Eat my tuna pasta salad, which I made last night at my mum’s. Pop to the corner shop though to buy some squash for work and some Snyder’s pretzel pieces for an after-pasta snack (£3 after round-up). Love me some snacks. Leave half the pasta salad.

8.30pm: Manage to crack on with some dusting and make some good wine sales. Decide to buy a bottle of ale. I didn’t used to like ales but discovered Bedlam Breweries Wilde East Coast pale ale last week and I loved it. Beautiful mango and guava taste. Hoping this gives me something similar. (£2.47 after 10% staff discount and use some loose change in my purse.)

9pm: Some last-minute sales and finished. Never know why people decide to come in two minutes before closing. Drive the minute home and pour myself a glass of Chapel Down Bacchus, finish the tuna pasta from earlier and debate whether to wash my hair and fake tan.

10.45pm: Did not fake tan or wash my hair. Instead fall asleep with the light on.

Total: £530.97

4.30am: Wake up, turn light off and fall back asleep knowing I have several hours before my alarm goes off.

7am: Alarm goes off. Lie in bed for a bit, then get up, dressed and leave at 7.50am for the stables.

8am: Arrive at the stables, muck out the horse’s stable and then try and catch her from the field. She does not like being caught. She will let me touch her bum but will then trot off, making sure she’s just out of reach. My friend turns up and manages to catch her by bribing her with a carrot.

8.40am: Tack up and ride. My old bridle that I found and cleaned up in the shed fits! That’s a nice amount of money saved.

9.30am: Finish riding, help J jump her horse. I have a can of Pepsi Max (I keep a supply in the boot of my car) and some pear drops that have turned into car sweets.

10.30am: Leave the stables and drive to my mum’s to find my old grooming kit. Also find an old brow band which I thought had been sold with an old bridle. Will add that to her bridle later as it’s a pretty chain one. J will turn her out tonight.

11.30am: Drive 10 minutes to the next village to go to the horse feed shop. Buy a 20kg bag of chaff and a bag of pong nuts. That will keep her going for a while. Comes to £14.60. Then pop into the Co-op petrol station opposite and grab some strawberries, yoghurt, a can of Monster Ultra, some Milky Way Stars and a bottle of smoothie. Comes to £10.59. Drive back home and contemplate whether to run before work.

2.30pm: I did not run before work. I napped instead and then showered.

3.50pm: Arrive at work with iced coffee made at home. Even if there were a coffee shop open nearby, I always prefer my own iced coffee to a coffee shop one. I used to be a barista when I was at uni so maybe that’s why. I give my colleague £8 for four face masks made by the local Women’s Institute. Her mum popped a post on the village’s Facebook helping page, saying they had loads at the community hub which is usually a food bank but with lots of extra bits set up during lockdown. I’ll end up with this money back from my mum for her masks at some point.

4pm: Work time! Today’s shift is nonstop. Constant restocking beer fridges and talking to people about wine, gin and local ales as Father’s Day is this weekend.

7pm: Snack on dried mango and a Brunch Bar. I’ve realised that I have the diet of a teenager this week.

8.30pm: Decide to buy an ale as I’m slowly getting into pale ales. This one pairs well with cheddar apparently. Comes to £2.47 after my 10% staff discount.

9pm: Finish work after a few late sales. Go to the Spar and get toilet roll, a can of Monster and chewing gum. Comes to £8 after the round-up. Heat up some tomato, mushroom, Quorn chicken and spinach spaghetti that I made the other day for dinner, and have a Diet Coke. I have zero motivation for cooking at the moment.

10pm: Gin and tonic (Limehouse gin), read Runner’s World and bed.

Total: £43.66

6.45am: Alarm goes off, get dressed in leggings and a long top and drive the 10 minutes to the stables.

7am: Arrive at the stables. My friend has already caught my horse for me and brought her in. She’s wet so I will ride after work when she’s dried off. I muck her out, fill up her water and leave her munching her hay in the stable.

8am: Arrive home, have a shower and a cooked breakfast of dippy eggs and soldiers. Soldiers are bread and butter; if you toast them, I’m sorry but that’s wrong and should be illegal.

9.50am: Leave for work. Spent so much time fannying around that I run out of time to make an iced coffee. This day will be long.

10am: Work nonstop ’til 4pm, dealing with telephone orders, customers and deliveries from suppliers. Work is relentless since the pubs shut but I like my regulars, and I’ve realised that we’ve replaced the barman in that people tell us their problems and we offer advice and comedic relief depending on the situation.

4pm: Finish work and straight out the door to the stables. I wore leggings and a sports bra to work in preparation. Horse is an angel again in the school and reminds me of just how well she’s been loved by who broke her in and brought her to the UK from the UAE. I turn her out after riding and she takes herself into the dirtiest mud patch and rolls. I’m convinced this horse knows that she is white.

6.30pm: Get home and make a very beige dinner of Quorn vegan fish filet, Quorn southern fried bites and curly fries. I eat about half of it and then end up in bed and fall asleep.

10pm: Wake up and realise that I’ve not had any alcoholic beverages or spent any money today. Am I a new woman? Go back to bed.

Total: £0

6.30am: Wake up and transfer £40 to have my horse’s shoes done. She’s just having fronts on, I’m not sure backs are necessary as I’m not doing loads of road work and she’s not a showjumper.

7am: Get changed into running clothes, contemplate going for a run. Change my mind and read Runner’s World while eating pain au chocolat in bed instead, knowing full well that I’ve not run in about 12 days. Oh the irony.

9.15am: Wake up to a voice message from my colleague saying that he won’t be in today as his mum has slipped in the shower and can’t move. A day of me and the boss then as we have a wine delivery coming in today.

10am: Get to work and the boss has changed my shift tomorrow to cover my colleague looking after his mum. I’m okay with this as instead of a 10am-5pm shift, I’m now on a 2pm-9pm shift which means I can ride in the morning with a bit of time before work, my parents can finally meet my horse, and I can try saddles on her. Not complaining.

3pm: We have literally not stopped. Fridays are the busiest day; they’re the new Saturdays since lockdown and the pubs shutting. On the loo, I check my phone and have been paid £68.50 for a security shift from two weeks ago. We get paid two weeks in arrears for our security shifts and usually I transfer all or half into my savings. However buying a horse has blown that one out of the window so I just leave it in my Monzo account for now. My colleague has also brought me a Subway cookie. We take it in turns to bring cookies in for each other to get us through our Friday shifts.

6.30pm: Shift finished! I end up buying a bottle of white wine (La Lisse Chenin Blanc) as I recommended it to a regular who used to work for the shop a few years ago based off everyone else’s purchases, and he told me that it was so good that I should buy it. I also grab a bottle of Old Dairy Frontline, which is a pale ale with 15p per every bottle going towards NHS charities, so that’s basically a good deed. Also grab a bottle of Bundaberg ginger beer. I LOVE ginger. Even my shampoo and conditioner is ginger. After staff discount (20% on wine and champagne, 10% on everything else), it comes to £11 after the round-up.

6.50pm: Arrive at the stables and watch some friends jump their horses. It’s good to get out even to spectate, and watching their lesson makes me glad that I don’t showjump anymore. I don’t need that stress or anxiety in my life.

9.30pm: Get back to the stables, chuck P out in the field and drive home.

10pm: Walk next door to the kebab shop and order a large vegetarian pizza for £8 using the change in the pot I empty coins into. One of the men delivers it (perks of being neighbours) about 15 minutes later and I sit on the sofa with the cat and eat half of the pizza with a Diet Pepsi before going to bed.

Total: £59

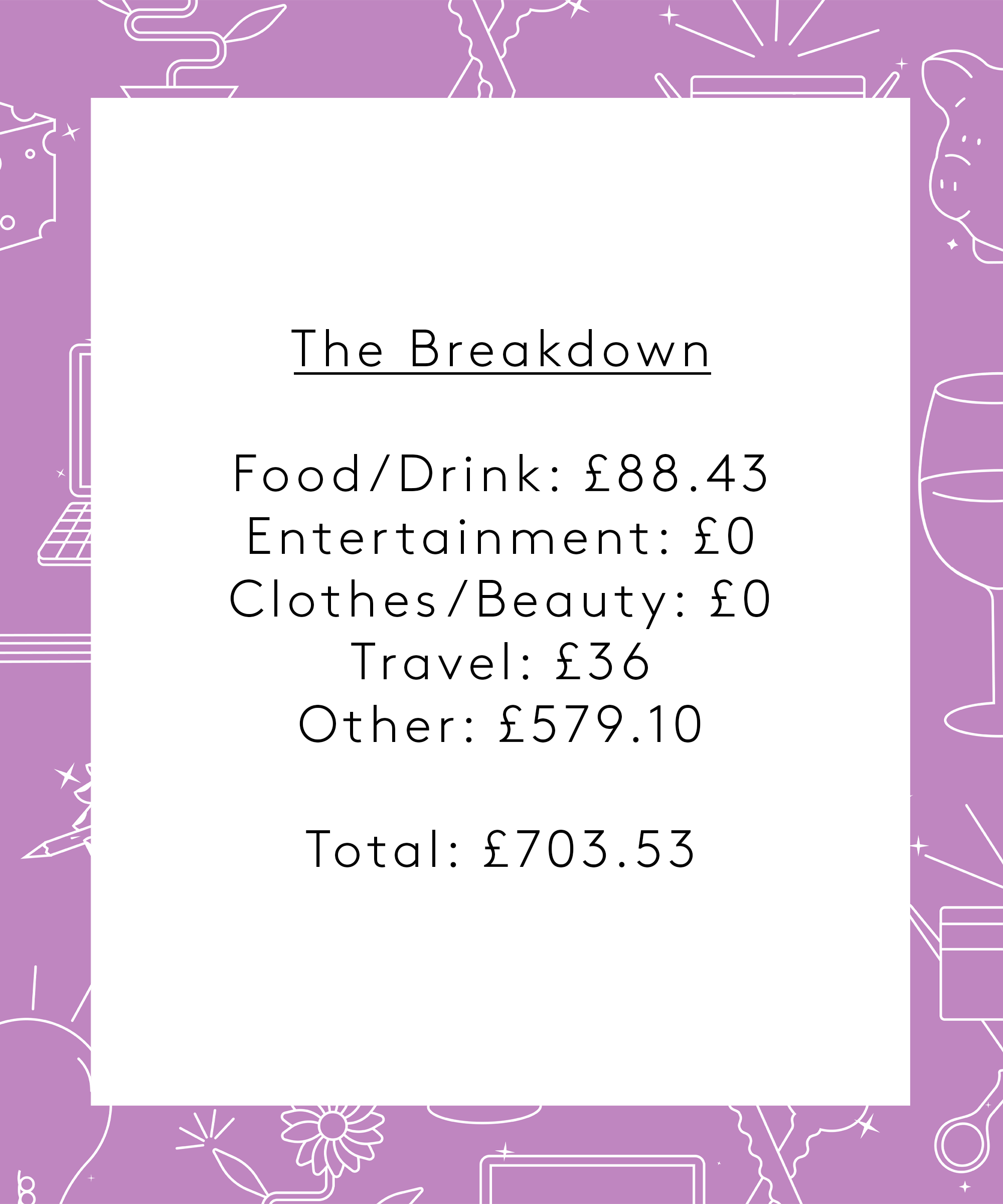

Food & Drink: £88.43

Entertainment: £0

Clothes & Beauty: £0

Travel: £36

Other: £579.10

Total: £703.53

Conclusion

“Obviously this is not a typical week of spending and I wouldn’t usually buy a horse! But after not riding for over two years, realising that a lot of my life is all work, work and more work, and there is never a right time to buy a horse, I decided to go ahead. This is probably the rightish time anyway as my bills and rent will go down when I move back in with my parents for the first time since uni. I’ve spent a bit much on food and booze this week, and need to get better at eating the food in my fridge and cupboards, and maybe drink a bit less. I’m also probably going to apply for the PGCE and give myself an actual career too.”

Like what you see? How about some more R29 goodness, right here?

Money Diary: Charity Researcher On £40k In London