Getting on the property ladder can feel like a pipe dream, especially when you’re trying to do it on your own. Saving for that all-important 10% deposit is one thing, but then there are the various other unavoidable costs to factor in.

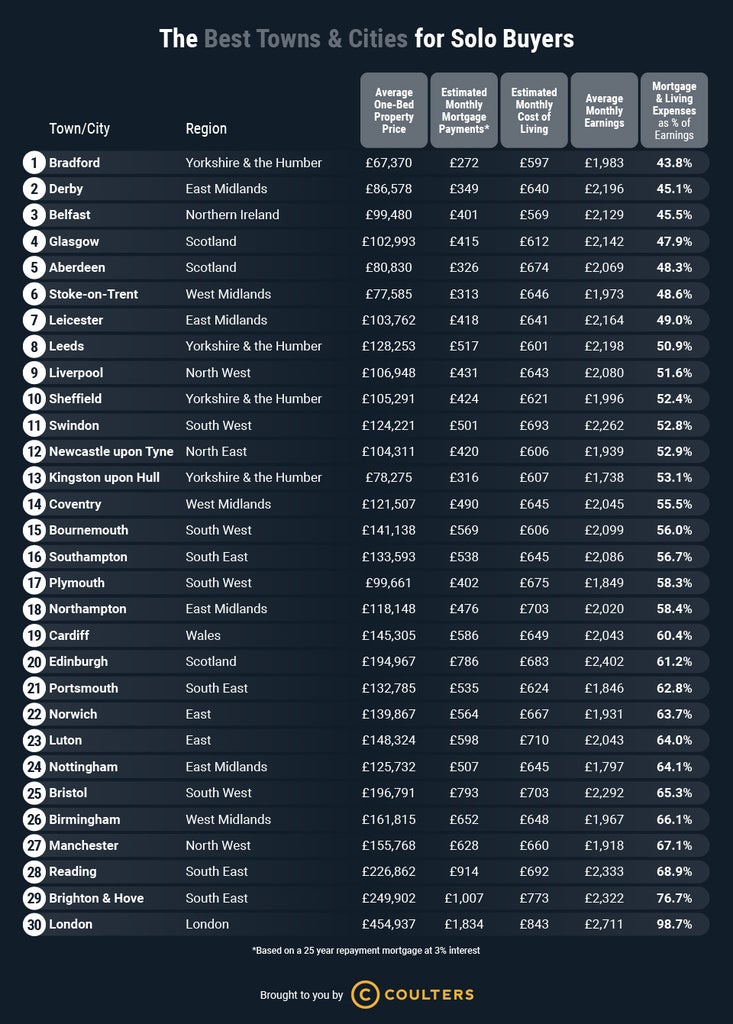

Of course, it goes without saying that it’s a little easier to take the leap in some parts of the country. According to new research by Coulters Property – which crunched the numbers in 30 of the UK’s biggest towns and cities – Bradford is the most affordable spot for solo buyers.

The average price of a one-bed in the West Yorkshire city is £67,370. This means that a typical mortgage repayment plus living costs would eat up just 43% of the average monthly income there.

Derby, Belfast, Glasgow, Aberdeen, Stoke-on-Trent and Leicester are relatively affordable for solo buyers too. In each of these cities, a typical mortgage repayment plus living costs would consume less than half of the average monthly income.

At the other end of the scale, London is unsurprisingly named the least affordable city for solo buyers. The average price of a one-bed in the capital is a hefty £454,937 – more than four times what you’d pay in Leeds, Liverpool or Glasgow.

Rather scarily, a typical mortgage repayment plus living costs in the capital would eat up 97% of the average monthly income. This makes getting on the property ladder without some help from “the bank of mum and dad” an even taller order.

Brighton and Hove is named the second least affordable city for solo buyers. The average price of a one-bed there is £249,902, which means a typical mortgage repayment plus living costs would eat up 76% of the average monthly income.

Popular commuter town Reading isn’t far behind with 69% of the average monthly income eaten up. Check out the full results below.

Like what you see? How about some more R29 goodness, right here?

Rent’s Dropped In These London Areas Due To Covid